Innovative Flavor Profiles

Innovation in flavor profiles is a significant driver within the baked chips market. Manufacturers are increasingly experimenting with unique and diverse flavors to attract a broader consumer base. This trend is evident as brands introduce exotic flavors, such as truffle, sriracha, and even dessert-inspired options. Market Research Future suggests that products featuring innovative flavors can command higher price points, contributing to an overall increase in revenue for the baked chips market. Furthermore, the introduction of limited-edition flavors has proven effective in generating consumer interest and driving sales. As competition intensifies, companies are likely to invest more in flavor innovation to differentiate their products and capture market share.

Rising Demand for Healthy Snacks

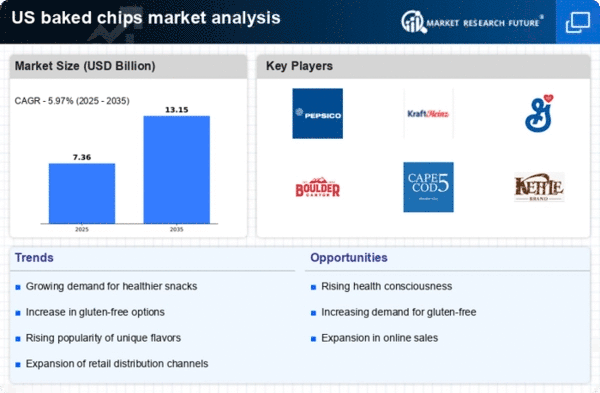

The baked chips market is experiencing a notable increase in demand for healthier snack options. As consumers become more health-conscious, they are actively seeking alternatives to traditional fried snacks. This shift is reflected in market data, which indicates that the sales of baked chips have risen by approximately 15% over the past year. The growing awareness of the negative health impacts associated with high-fat snacks is driving this trend. Additionally, the baked chips market is benefiting from the increasing prevalence of diet-related health issues, such as obesity and diabetes, prompting consumers to opt for lower-calorie, lower-fat snack choices. This demand for healthier options is likely to continue influencing product development and marketing strategies within the baked chips market.

Expansion of Distribution Channels

The baked chips market is benefiting from the expansion of distribution channels, which enhances product accessibility for consumers. Retailers are increasingly recognizing the demand for baked chips and are allocating more shelf space to these products. Additionally, the rise of e-commerce has transformed the way consumers purchase snacks, with online sales of baked chips growing significantly. This shift in purchasing behavior is supported by data indicating that online grocery sales have surged by over 30% in recent years. As distribution channels continue to evolve, the baked chips market is likely to see increased competition and innovation, as brands seek to capitalize on new opportunities to reach consumers.

Sustainability and Ethical Sourcing

Sustainability is becoming a crucial consideration for consumers in the baked chips market. There is a growing expectation for brands to adopt environmentally friendly practices and source ingredients ethically. This shift is reflected in consumer preferences, with many willing to pay a premium for products that align with their values. Market data suggests that brands emphasizing sustainability can see an increase in customer loyalty and sales. As a result, manufacturers are increasingly focusing on sustainable packaging solutions and responsible sourcing of ingredients. This trend is likely to influence the baked chips market, as companies strive to meet consumer expectations and enhance their brand image through sustainable practices.

Increased Availability of Gluten-Free Options

The baked chips market is witnessing a surge in the availability of gluten-free products, catering to the growing population of consumers with gluten sensitivities and celiac disease. This trend is supported by data indicating that gluten-free product sales have increased by over 20% in recent years. As more consumers seek gluten-free alternatives, manufacturers are expanding their product lines to include baked chips made from alternative grains such as quinoa, chickpeas, and lentils. This diversification not only meets consumer demand but also enhances the overall appeal of the baked chips market. The emphasis on gluten-free options is likely to continue shaping product offerings and marketing strategies in the industry.