Increased Research Funding

The bacterial cell-culture market is experiencing a surge in research funding from both public and private sectors. In the US, government agencies such as the National Institutes of Health (NIH) have significantly increased their budgets for microbiological research, which directly benefits the bacterial cell-culture market. This influx of capital is likely to enhance the development of innovative cell-culture techniques and products. Furthermore, private investments in biotechnology firms are also on the rise, with estimates suggesting that funding could reach upwards of $10 billion annually by 2026. This financial support is crucial for advancing research and development, thereby driving growth in the bacterial cell-culture market. As a result, the market is poised for expansion, with new technologies and methodologies emerging to meet the evolving needs of researchers and the healthcare industry.

Emerging Regulatory Frameworks

The bacterial cell-culture market is influenced by the development of emerging regulatory frameworks aimed at ensuring safety and efficacy in biotechnological applications. Regulatory bodies in the US, such as the Food and Drug Administration (FDA), are establishing guidelines that govern the use of bacterial cultures in research and product development. These regulations are designed to promote innovation while safeguarding public health. As compliance becomes increasingly important, companies operating in the bacterial cell-culture market must adapt to these evolving standards. This regulatory landscape may initially pose challenges, but it also presents opportunities for companies that can navigate these complexities effectively. The establishment of clear guidelines is likely to enhance consumer confidence and drive market growth in the long term.

Rising Focus on Synthetic Biology

The bacterial cell-culture market is witnessing a notable shift towards synthetic biology, which emphasizes the design and construction of new biological parts and systems. This trend is fueled by advancements in genetic engineering and biotechnology, enabling researchers to manipulate bacterial cells for various applications. The US market for synthetic biology is expected to reach $40 billion by 2026, with bacterial cell cultures serving as foundational tools for these innovations. As synthetic biology continues to evolve, the demand for sophisticated bacterial cell-culture systems is likely to increase, driving growth in the market. This intersection of synthetic biology and bacterial cell culture presents opportunities for novel applications in medicine, agriculture, and environmental science, thereby expanding the market's scope.

Growing Applications in Drug Development

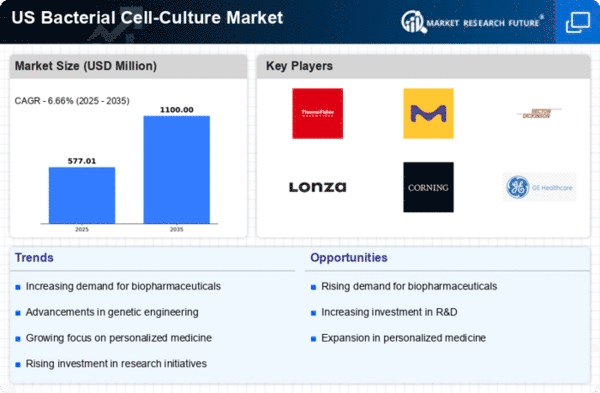

The bacterial cell-culture market is increasingly recognized for its pivotal role in drug development processes. Pharmaceutical companies are leveraging bacterial cell cultures for the production of recombinant proteins, vaccines, and other biologics. The market is projected to grow at a CAGR of approximately 8% through 2027, driven by the rising demand for biologics and the need for efficient drug testing methods. Bacterial cell cultures provide a cost-effective and scalable solution for producing therapeutic agents, which is particularly appealing in the current landscape of drug development. Moreover, the ability to rapidly produce and test new compounds using bacterial cultures is likely to accelerate the overall drug development timeline, further solidifying the importance of this market in the pharmaceutical sector.

Advancements in Automation and Technology

The bacterial cell-culture market is benefiting from advancements in automation and technology, which are transforming traditional laboratory practices. Automated systems for cell culture, monitoring, and analysis are becoming more prevalent, leading to increased efficiency and reproducibility in experiments. The integration of artificial intelligence and machine learning into cell-culture processes is also gaining traction, potentially reducing human error and optimizing outcomes. As laboratories in the US adopt these technologies, the bacterial cell-culture market is expected to expand, with estimates suggesting a growth rate of around 7% annually through 2028. These technological innovations not only streamline workflows but also enhance the capabilities of researchers, allowing for more complex and high-throughput studies.