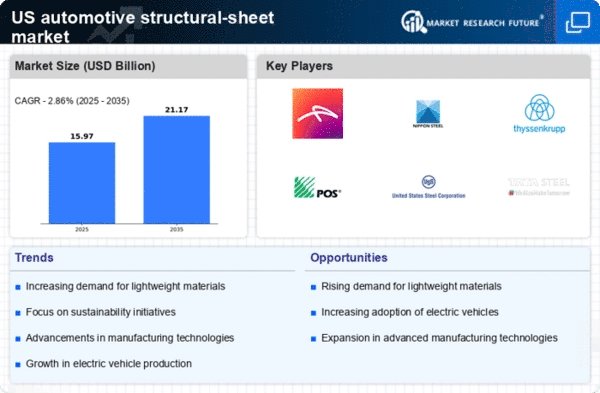

Rising Demand for Electric Vehicles

The automotive structural-sheet market experiences a notable driver in the rising demand for electric vehicles (EVs). As consumers increasingly prioritize sustainability, manufacturers are compelled to adapt their production processes. The shift towards EVs necessitates lightweight materials to enhance efficiency and range, thereby driving the demand for advanced structural sheets. In 2025, the EV market in the US is projected to grow by approximately 30%, which directly influences the automotive structural-sheet market. This growth is likely to encourage innovations in material science, leading to the development of high-strength, lightweight sheets that meet the specific requirements of electric vehicle designs. Consequently, the automotive structural-sheet market is poised to benefit from this transition, as manufacturers seek to optimize vehicle performance while adhering to environmental standards.

Consumer Preferences for Customization

Consumer preferences for vehicle customization are emerging as a notable driver in the automotive structural-sheet market. As buyers increasingly seek personalized vehicles, manufacturers are adapting their offerings to meet these demands. This trend necessitates the use of versatile structural sheets that can accommodate various design modifications while maintaining structural integrity. The automotive structural-sheet market is likely to benefit from this shift, as manufacturers invest in materials that allow for greater flexibility in design. In 2025, the market is projected to grow by around 12%, driven by the need for customizable solutions that cater to individual consumer preferences. This trend may encourage innovation in material properties, leading to the development of sheets that are not only lightweight but also adaptable to diverse vehicle configurations.

Regulatory Compliance and Safety Standards

Regulatory compliance and safety standards significantly influence the automotive structural-sheet market. As safety regulations become more stringent, manufacturers are compelled to enhance the structural integrity of vehicles. This necessitates the use of high-performance materials that can withstand crash tests and provide better protection for occupants. In the US, the National Highway Traffic Safety Administration (NHTSA) has implemented various safety standards that directly impact vehicle design and manufacturing. The automotive structural-sheet market is likely to see an increase in demand for materials that meet these evolving safety requirements. In 2025, it is anticipated that the market will grow by approximately 10% as manufacturers prioritize compliance with safety regulations, thereby driving the need for advanced structural sheets that offer superior crashworthiness.

Technological Advancements in Manufacturing

Technological advancements in manufacturing processes serve as a significant driver for the automotive structural-sheet market. Innovations such as advanced stamping techniques and automated production lines enhance efficiency and precision in the fabrication of structural sheets. The integration of Industry 4.0 technologies, including IoT and AI, allows for real-time monitoring and optimization of production processes. This not only reduces waste but also lowers production costs, making it more feasible for manufacturers to invest in high-quality materials. In 2025, the automotive structural-sheet market is expected to witness a growth rate of around 15% due to these technological improvements. As manufacturers adopt these cutting-edge technologies, the demand for innovative structural sheets that can withstand rigorous performance standards is likely to increase, further propelling market growth.

Sustainability Initiatives in Automotive Production

Sustainability initiatives in automotive production are increasingly shaping the automotive structural-sheet market. As manufacturers strive to reduce their carbon footprint, there is a growing emphasis on using eco-friendly materials and processes. This shift towards sustainability is likely to drive the demand for structural sheets made from recycled or bio-based materials. In 2025, the automotive structural-sheet market is expected to expand by approximately 8% as companies adopt greener practices. The integration of sustainable materials not only aligns with consumer expectations but also helps manufacturers comply with environmental regulations. Consequently, the automotive structural-sheet market is poised to evolve, with an increasing focus on developing innovative materials that support sustainability goals while ensuring performance and safety.