Increased Investment in R&D

Investment in research and development (R&D) is a critical factor propelling the automotive robotics market forward. As companies seek to innovate and stay competitive, R&D expenditures are expected to rise significantly. In 2025, it is projected that R&D investments in robotics could increase by 18%, focusing on developing next-generation automation solutions. This influx of funding is likely to accelerate the pace of innovation, leading to the introduction of more advanced robotic systems that can enhance productivity and efficiency. The automotive robotics market stands to gain substantially from this trend, as companies leverage R&D to drive technological advancements.

Rising Demand for Efficiency

The automotive robotics market is experiencing a notable surge in demand for enhanced efficiency in manufacturing processes. As automakers strive to reduce production costs and improve output quality, the integration of robotics becomes increasingly vital. In 2025, it is estimated that the adoption of robotics in automotive manufacturing could lead to a reduction in labor costs by up to 30%. This shift not only streamlines operations but also minimizes human error, thereby enhancing product quality. The automotive robotics market is thus positioned to benefit from this trend, as manufacturers seek to optimize their production lines and meet the growing consumer demand for high-quality vehicles.

Growing Focus on Safety Standards

The automotive robotics market is increasingly shaped by the heightened emphasis on safety standards within manufacturing environments. As regulations become more stringent, manufacturers are compelled to adopt robotic solutions that not only enhance productivity but also ensure worker safety. In 2025, it is anticipated that investments in safety-compliant robotics will rise by 20%. This trend reflects a broader commitment to creating safer workplaces while maintaining high production levels. Consequently, the automotive robotics market is expected to expand as companies prioritize safety alongside efficiency in their operations.

Advancements in Robotics Technology

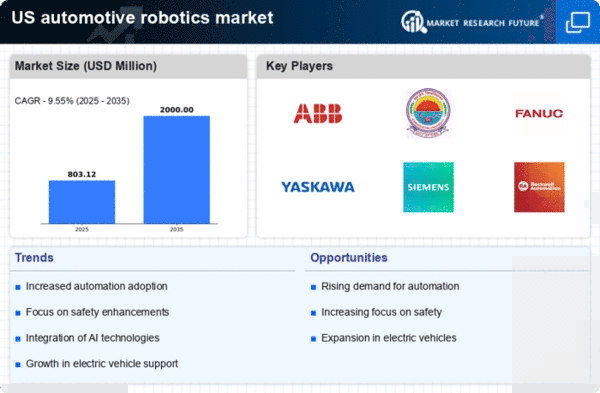

Technological advancements are significantly influencing the automotive robotics market. Innovations in robotics, such as improved sensors, enhanced AI capabilities, and better machine learning algorithms, are enabling more sophisticated automation solutions. In 2025, the market is projected to grow at a CAGR of 15%, driven by these technological improvements. These advancements allow for greater flexibility in manufacturing processes, enabling companies to adapt quickly to changing market demands. As a result, the automotive robotics market is likely to see increased investment in cutting-edge technologies that enhance operational efficiency and product quality.

Shift Towards Sustainable Manufacturing

Sustainability is becoming a pivotal driver in the automotive robotics market. As environmental concerns gain prominence, manufacturers are increasingly adopting robotics to minimize waste and energy consumption. The integration of robotics can lead to a reduction in material waste by approximately 25%, aligning with the industry's sustainability goals. In 2025, the automotive robotics market is likely to see a significant uptick in demand for eco-friendly robotic solutions. This shift not only addresses regulatory pressures but also resonates with consumer preferences for environmentally responsible products, thereby fostering market growth.