Emergence of Hybrid Vehicles

The emergence of hybrid vehicles is reshaping the automotive pumps market, as these vehicles require specialized pumps to manage both electric and internal combustion engine systems. The hybrid vehicle segment is expected to grow at a rate of 10% annually, creating a substantial demand for innovative pump solutions. This trend suggests that manufacturers must invest in developing pumps that can efficiently handle the unique requirements of hybrid technology. As the market adapts to this shift, the automotive pumps market is likely to see a diversification of product offerings, catering to the evolving landscape of vehicle technology.

Increased Focus on Aftermarket Services

The automotive pumps market is witnessing an increased focus on aftermarket services, which is becoming a crucial driver of growth. As vehicles age, the need for replacement and maintenance of pumps becomes essential. This trend is particularly pronounced in the US, where the average vehicle age is over 12 years. The aftermarket segment is projected to account for approximately 40% of the total automotive pumps market by 2025. This shift indicates that manufacturers and suppliers must develop strategies to cater to the aftermarket, ensuring that they provide high-quality products and services to meet consumer needs.

Growth in Automotive Production and Sales

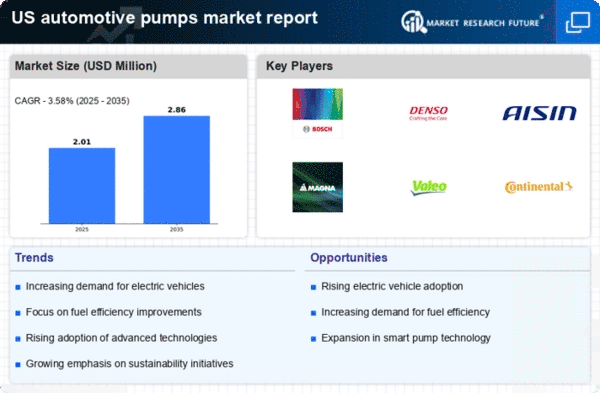

The automotive pumps market is closely tied to the overall growth in automotive production and sales in the US. With a projected increase in vehicle production by 5% in 2025, the demand for automotive pumps is expected to rise correspondingly. This growth is driven by consumer preferences for new vehicles, which often feature advanced pump technologies. As manufacturers ramp up production to meet this demand, the automotive pumps market is likely to expand, creating opportunities for suppliers and manufacturers alike. The market's value is anticipated to reach $3 billion by the end of 2025.

Technological Advancements in Automotive Pumps

the automotive pumps market is experiencing significant technological advancements that enhance vehicle efficiency and performance.. Innovations such as variable displacement pumps and electric pumps are becoming increasingly prevalent. These advancements not only improve fuel efficiency but also reduce emissions, aligning with the growing consumer demand for eco-friendly vehicles. In 2025, the market for electric pumps is projected to reach approximately $1.5 billion, indicating a robust growth trajectory. As manufacturers invest in research and development, the automotive pumps market is likely to witness a transformation that could redefine performance standards in the industry.

Rising Demand for Advanced Driver Assistance Systems (ADAS)

The automotive pumps market is significantly influenced by the rising demand for Advanced Driver Assistance Systems (ADAS). These systems require sophisticated hydraulic and fuel pumps to function effectively, thereby driving the market's growth. As safety regulations become more stringent, the integration of ADAS in vehicles is expected to increase, leading to a projected growth rate of 8% annually in the automotive pumps market. This trend suggests that manufacturers must adapt their product offerings to meet the evolving needs of the automotive industry, ensuring that pumps are compatible with advanced technologies.