Investment in Research and Development

The automotive power-electronics market is experiencing a surge in investment in research and development (R&D) activities. As competition intensifies, manufacturers are allocating significant resources to innovate and improve power electronics technologies. This focus on R&D is essential for developing next-generation components that enhance vehicle performance, efficiency, and safety. In 2025, it is projected that R&D expenditures in the automotive power-electronics market will exceed $8 billion, reflecting the industry's commitment to technological advancement. This investment not only fosters innovation but also positions companies to capitalize on emerging trends, thereby driving growth in the automotive power-electronics market.

Increasing Demand for Energy Efficiency

The automotive power-electronics market is experiencing a notable surge in demand for energy-efficient solutions. As consumers become more environmentally conscious, automakers are compelled to enhance the energy efficiency of their vehicles. This trend is reflected in the growing adoption of power electronics, which facilitate better energy management and reduce overall energy consumption. In 2025, it is estimated that energy-efficient vehicles will account for approximately 30% of total vehicle sales in the US. This shift not only aligns with regulatory pressures for lower emissions but also caters to consumer preferences for sustainable options. Consequently, the automotive power-electronics market is likely to expand as manufacturers invest in innovative technologies that promote energy efficiency.

Regulatory Compliance and Emission Standards

The automotive power-electronics market is significantly influenced by stringent regulatory compliance and emission standards set by government authorities. In the US, regulations aimed at reducing greenhouse gas emissions are becoming increasingly rigorous. For instance, the Corporate Average Fuel Economy (CAFE) standards mandate that automakers achieve specific fuel efficiency targets. As a result, manufacturers are integrating advanced power electronics to optimize engine performance and reduce emissions. This regulatory landscape is expected to drive the automotive power-electronics market, as companies seek to meet compliance requirements while maintaining competitive advantages. By 2025, it is projected that compliance-related investments in power electronics will exceed $10 billion, underscoring the critical role of regulations in shaping market dynamics.

Technological Advancements in Power Electronics

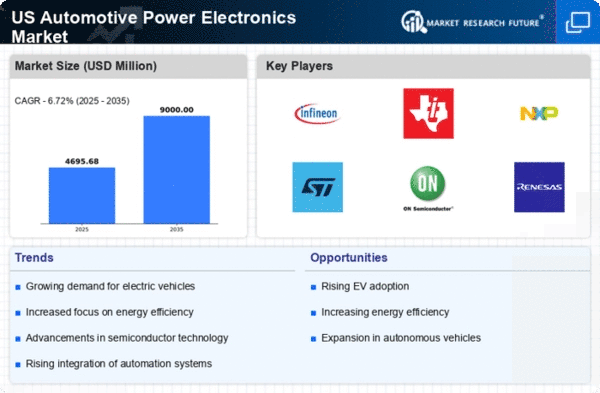

The automotive power-electronics market is poised for growth due to rapid technological advancements in power electronics components. Innovations such as silicon carbide (SiC) and gallium nitride (GaN) semiconductors are enhancing the performance and efficiency of power electronics systems. These materials offer superior thermal performance and efficiency, which are crucial for electric and hybrid vehicles. As manufacturers increasingly adopt these advanced materials, the automotive power-electronics market is likely to witness a compound annual growth rate (CAGR) of around 15% through 2025. This technological evolution not only improves vehicle performance but also reduces costs associated with energy consumption, thereby attracting more investments in the sector.

Rising Popularity of Hybrid and Electric Vehicles

The automotive power-electronics market is benefiting from the rising popularity of hybrid and electric vehicles (HEVs and EVs). As consumer preferences shift towards greener alternatives, automakers are investing heavily in power electronics to enhance vehicle performance and efficiency. In 2025, it is anticipated that the market for electric vehicles will reach approximately 5 million units sold in the US, representing a substantial increase from previous years. This growth is driving demand for advanced power electronics systems that manage energy flow and optimize battery performance. Consequently, the automotive power-electronics market is likely to expand as manufacturers strive to meet the increasing demand for HEVs and EVs.