Expansion of Aftermarket Services

The automotive leaf-spring market is benefiting from the expansion of aftermarket services in the US. As vehicle ownership rates rise, the demand for replacement parts and upgrades is increasing. Consumers are more inclined to invest in aftermarket enhancements to improve vehicle performance and comfort. This trend is particularly evident in the light truck and SUV segments, where leaf springs are often replaced or upgraded to enhance load capacity and ride quality. The aftermarket segment is projected to grow at a rate of 10% annually, indicating a robust opportunity for manufacturers in the automotive leaf-spring market. This growth is likely to encourage innovation and diversification of product offerings, catering to the evolving preferences of consumers.

Growth of Electric Vehicle Segment

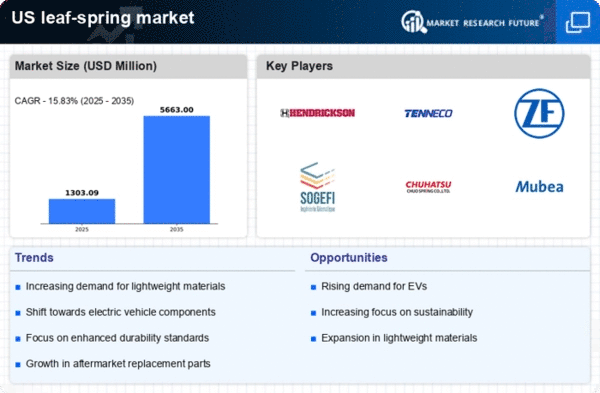

The automotive leaf-spring market is poised for transformation due to the rapid growth of the electric vehicle (EV) segment in the US. As consumers increasingly opt for EVs, manufacturers are adapting their designs to accommodate the unique requirements of electric drivetrains. Leaf springs, known for their lightweight and durable characteristics, are becoming integral to the suspension systems of these vehicles. The EV market is projected to expand significantly, with estimates indicating that electric vehicles could represent over 30% of new car sales by 2030. This shift presents a substantial opportunity for the automotive leaf-spring market, as manufacturers seek to develop specialized products that cater to the performance and efficiency needs of electric vehicles.

Rising Demand for Commercial Vehicles

The automotive leaf-spring market experiences a notable boost due to the increasing demand for commercial vehicles in the US. As businesses expand and logistics operations grow, the need for reliable and durable suspension systems becomes paramount. The commercial vehicle segment, which includes trucks and vans, is projected to account for a substantial share of the market, with estimates suggesting it could reach approximately 40% of total sales by 2026. This trend indicates a robust growth trajectory for the automotive leaf-spring market, as manufacturers strive to meet the evolving requirements of commercial fleets. Enhanced load-bearing capabilities and improved ride quality are essential features that drive the adoption of leaf springs in this sector, thereby reinforcing their significance in the automotive landscape.

Increased Focus on Vehicle Safety Standards

The automotive leaf-spring market is significantly impacted by the heightened focus on vehicle safety standards in the US. Regulatory bodies are continuously updating safety regulations, which necessitate the incorporation of advanced suspension systems that enhance vehicle stability and control. Leaf springs play a critical role in ensuring that vehicles meet these stringent safety requirements. As a result, manufacturers are compelled to innovate and improve their products to comply with evolving standards. This trend is expected to drive market growth, with estimates suggesting that compliance-related investments could account for up to 20% of total production costs in the automotive leaf-spring market. Consequently, the emphasis on safety is likely to foster a more competitive environment among manufacturers.

Technological Advancements in Manufacturing

Technological innovations in manufacturing processes are significantly influencing the automotive leaf-spring market. The introduction of advanced materials and production techniques, such as computer-aided design (CAD) and automated assembly lines, enhances the efficiency and precision of leaf spring production. These advancements not only reduce manufacturing costs but also improve the overall quality and performance of the products. For instance, the integration of high-strength steel and composite materials is becoming increasingly common, allowing for lighter and more resilient leaf springs. As a result, manufacturers are likely to see a rise in demand, with projections indicating a potential market growth of 15% annually over the next five years. This technological evolution is crucial for maintaining competitiveness in the automotive leaf-spring market.