Rising Demand for Fuel Efficiency

The automatic transmission market is experiencing a notable surge in demand for fuel-efficient vehicles. As consumers become increasingly conscious of fuel costs and environmental impacts, manufacturers are responding by integrating advanced automatic transmission systems that enhance fuel economy. According to recent data, vehicles equipped with automatic transmissions can achieve fuel efficiency improvements of up to 10-15% compared to their manual counterparts. This trend is particularly pronounced in the compact and mid-size vehicle segments, where consumers prioritize both performance and economy. The automatic transmission market is thus adapting to these consumer preferences, leading to innovations that not only meet regulatory standards but also appeal to eco-conscious buyers.

Increased Focus on Safety Features

The automatic transmission market is increasingly shaped by a heightened focus on safety features in vehicles. As consumers prioritize safety, manufacturers are integrating advanced safety technologies that work in conjunction with automatic transmissions. Features such as automatic emergency braking and collision avoidance systems are becoming standard, enhancing the overall safety profile of vehicles. Data shows that vehicles equipped with these safety features experience a reduction in accident rates by up to 20%. Consequently, the automatic transmission market is compelled to align its offerings with these safety advancements, ensuring that automatic transmissions are compatible with the latest safety technologies.

Technological Integration in Vehicles

The automatic transmission market is significantly influenced by the integration of advanced technologies in vehicles. Innovations such as adaptive cruise control, lane-keeping assistance, and automated driving systems are increasingly being paired with automatic transmissions. This synergy enhances overall vehicle performance and safety, making automatic transmissions more appealing to consumers. Data indicates that vehicles featuring these technologies are projected to capture a larger market share, with automatic transmission systems being a critical component. The automatic transmission market is thus evolving to incorporate these technologies, which not only improve driving experiences but also align with the growing trend towards smart and connected vehicles.

Shift Towards Electric and Hybrid Vehicles

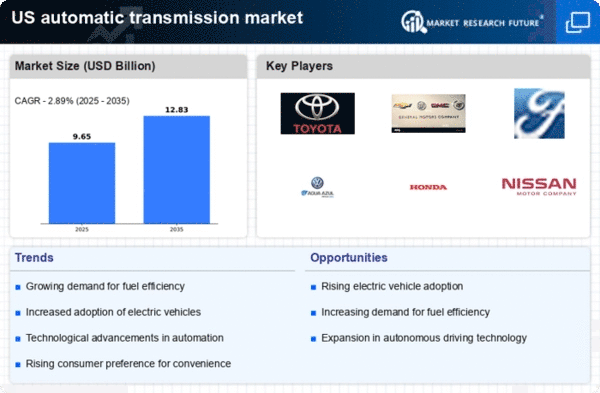

The automatic transmission market is witnessing a transformative shift as electric and hybrid vehicles gain traction. While traditional automatic transmissions are prevalent in gasoline-powered vehicles, the rise of electric drivetrains presents both challenges and opportunities for the market. Hybrid vehicles often utilize automatic transmissions to optimize performance and efficiency, which could lead to a sustained demand for these systems. Recent projections suggest that by 2030, hybrid and electric vehicles may account for over 30% of new vehicle sales in the US. This shift compels the automatic transmission market to innovate and adapt, ensuring compatibility with emerging technologies while maintaining performance standards.

Growing Urbanization and Mobility Solutions

The automatic transmission market is being driven by the trends of urbanization and the demand for efficient mobility solutions. As urban populations grow, the need for compact, easy-to-drive vehicles increases, with automatic transmissions being favored for their convenience in stop-and-go traffic. Recent studies indicate that urban areas are witnessing a rise in the adoption of automatic transmission vehicles, with a projected increase of 25% in urban vehicle sales by 2027. This trend compels the automatic transmission market to focus on developing systems that cater to urban driving conditions, enhancing the overall driving experience in congested environments.