US Asphalt Additives Market Summary

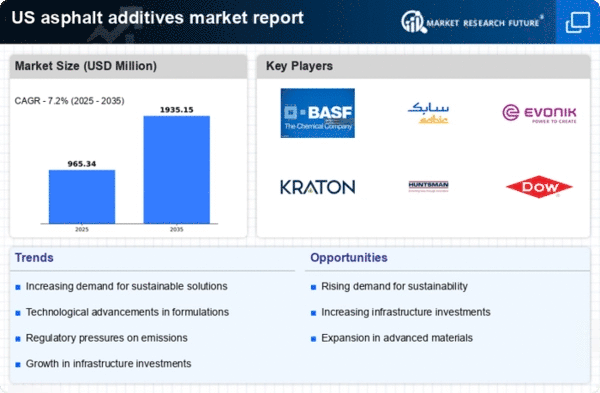

As per Market Research Future analysis, the US asphalt additives market Size was estimated at 900.5 USD Million in 2024. The US asphalt additives market is projected to grow from 965.34 USD Million in 2025 to 1935.15 USD Million by 2035, exhibiting a compound annual growth rate (CAGR) of 7% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The US The asphalt additives market is shifting towards sustainability and technological innovation.

- Sustainable additives are gaining traction as environmental concerns drive demand for eco-friendly solutions.

- Technological advancements in asphalt production are enhancing performance and durability, appealing to industry stakeholders.

- Regulatory compliance is becoming increasingly critical, influencing the adoption of innovative materials and practices.

- Rising infrastructure investments and growing demand for high-performance materials are key drivers propelling market growth.

Market Size & Forecast

| 2024 Market Size | 900.5 (USD Million) |

| 2035 Market Size | 1935.15 (USD Million) |

| CAGR (2025 - 2035) | 7.2% |

Major Players

BASF SE (DE), SABIC (SA), Evonik Industries AG (DE), Kraton Corporation (US), Huntsman Corporation (US), Dow Inc. (US), TotalEnergies SE (FR), Arkema SA (FR), W.R. Grace & Co. (US)