Rising Energy Demand

The ASEAN Energy-Transition Market is significantly influenced by the rising energy demand across the region. Rapid urbanization and economic growth have led to an increased need for energy, particularly in developing countries within ASEAN. This demand is expected to rise by 4% annually, necessitating a shift towards more sustainable energy sources. The transition to renewable energy is seen as a viable solution to meet this growing demand while reducing carbon emissions. Consequently, the asean energy-transition market is likely to expand as countries invest in infrastructure to support renewable energy generation, thereby addressing both energy security and environmental concerns.

Investment in Energy Infrastructure

Investment in energy infrastructure is a critical driver of the ASEAN Energy-Transition Market. Governments and private entities are channeling funds into the development of renewable energy projects, smart grids, and energy efficiency programs. In 2025, it is estimated that investments in renewable energy infrastructure will reach approximately $200 billion across the ASEAN region. This influx of capital not only supports the transition to cleaner energy sources but also creates job opportunities and stimulates economic growth. The focus on modernizing energy infrastructure is essential for facilitating the integration of renewable energy into existing systems, thereby enhancing the overall efficiency of the asean energy-transition market.

Regulatory Support for Clean Energy

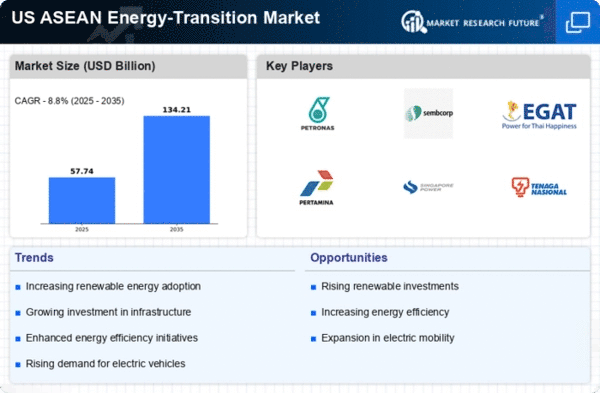

The ASEAN Energy-Transition Market is experiencing a surge in regulatory support aimed at promoting clean energy initiatives. Governments are implementing policies that incentivize renewable energy investments, such as tax credits and subsidies. For instance, the introduction of feed-in tariffs has encouraged the development of solar and wind projects across the region. This regulatory framework not only fosters innovation but also attracts foreign direct investment, which is crucial for the growth of the asean energy-transition market. As a result, the market is projected to grow at a compound annual growth rate (CAGR) of approximately 8% over the next five years, reflecting the increasing commitment to sustainable energy solutions.

Public Awareness and Consumer Demand

Public awareness regarding climate change and environmental sustainability is driving consumer demand for renewable energy solutions in the ASEAN Energy-Transition Market. As individuals and businesses become more conscious of their carbon footprints, there is a growing preference for clean energy options. Surveys indicate that over 70% of consumers in the region are willing to pay a premium for renewable energy sources. This shift in consumer behavior is prompting energy providers to diversify their offerings and invest in sustainable practices. Consequently, the asean energy-transition market is likely to see increased competition among energy suppliers, leading to more innovative and affordable renewable energy solutions.

Technological Innovation in Renewable Energy

Technological innovation plays a pivotal role in shaping the ASEAN Energy-Transition Market. Advances in renewable energy technologies, such as solar photovoltaic systems and wind turbines, have significantly reduced costs and improved efficiency. For example, the cost of solar energy has decreased by over 80% in the last decade, making it a competitive alternative to fossil fuels. This trend is expected to continue, with further innovations enhancing energy storage solutions and grid integration. As a result, the asean energy-transition market is likely to benefit from these technological advancements, leading to increased adoption of renewable energy sources and a more resilient energy infrastructure.