Aging Population

The demographic shift towards an aging population in the United States is a significant driver of the US Anticoagulation Market. As individuals age, the risk of developing conditions that require anticoagulation therapy, such as atrial fibrillation and deep vein thrombosis, increases. The US Census Bureau projects that by 2030, one in five Americans will be of retirement age, leading to a higher prevalence of age-related health issues. This demographic trend is likely to result in a greater demand for anticoagulants, as older adults often require long-term management of their health conditions. Consequently, pharmaceutical companies may focus on developing age-appropriate formulations and delivery systems, further stimulating growth in the US Anticoagulation Market. The intersection of an aging population and the need for effective anticoagulation therapies presents a compelling opportunity for market expansion.

Rising Awareness and Education

There is a growing emphasis on patient education and awareness regarding anticoagulation therapy within the US Anticoagulation Market. Healthcare providers are increasingly recognizing the importance of educating patients about the risks and benefits of anticoagulant medications. This focus on education is crucial, as informed patients are more likely to adhere to their treatment regimens, which can lead to better health outcomes. Various initiatives, including community outreach programs and digital health platforms, aim to enhance patient understanding of anticoagulation therapy. As awareness increases, the demand for anticoagulants is expected to rise, as patients become more proactive in managing their health. This trend may also encourage pharmaceutical companies to invest in educational resources, further supporting the growth of the US Anticoagulation Market.

Regulatory Support and Guidelines

The US Anticoagulation Market benefits from robust regulatory support and updated clinical guidelines that promote the safe and effective use of anticoagulants. Organizations such as the American College of Cardiology and the American Heart Association regularly publish guidelines that inform healthcare providers about the best practices for anticoagulation therapy. These guidelines are instrumental in standardizing treatment protocols and ensuring that patients receive optimal care. Furthermore, the US Food and Drug Administration continues to evaluate and approve new anticoagulant therapies, which enhances the market's dynamism. The alignment of regulatory frameworks with clinical needs may lead to increased adoption of anticoagulants, thereby driving market growth. As healthcare professionals become more familiar with the latest guidelines, the US Anticoagulation Market is likely to see a rise in the utilization of these therapies.

Advancements in Anticoagulant Therapies

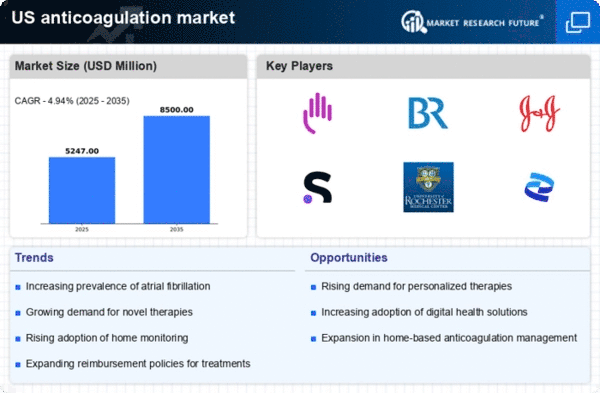

Innovations in anticoagulant therapies are reshaping the US Anticoagulation Market. The introduction of novel oral anticoagulants (NOACs) has provided patients with more options that offer advantages over traditional therapies, such as warfarin. These advancements are characterized by improved safety profiles, reduced monitoring requirements, and more predictable pharmacokinetics. According to recent data, the market for NOACs is projected to grow significantly, with estimates suggesting a compound annual growth rate of over 10% in the coming years. This growth is indicative of a shift in treatment paradigms, as healthcare providers increasingly adopt these newer agents for their patients. The ongoing research and development efforts aimed at enhancing the efficacy and safety of anticoagulants are likely to further propel the US Anticoagulation Market, as they address the evolving needs of patients and healthcare systems.

Increasing Prevalence of Cardiovascular Diseases

The US Anticoagulation Market is experiencing growth due to the rising prevalence of cardiovascular diseases, which are among the leading causes of morbidity and mortality in the United States. According to the Centers for Disease Control and Prevention, nearly half of all adults in the US have some form of cardiovascular disease. This alarming statistic drives the demand for anticoagulant therapies, as they are essential in managing conditions such as atrial fibrillation and venous thromboembolism. As healthcare providers increasingly recognize the importance of anticoagulation in preventing serious complications, the market is likely to expand further. The growing awareness of cardiovascular health and the need for effective treatment options may lead to increased investments in research and development, thereby enhancing the overall landscape of the US Anticoagulation Market.