Expansion of the Aviation Sector

The US Aircraft Auxiliary Power Unit Market is poised for growth due to the expansion of the aviation sector. With increasing air travel demand, airlines are expanding their fleets and investing in new aircraft, which in turn drives the need for efficient APUs. The Federal Aviation Administration (FAA) projects a steady increase in passenger traffic, which is expected to reach over 1 billion by 2030. This growth necessitates the integration of advanced APUs to support the operational needs of modern aircraft. As airlines focus on enhancing passenger experience and operational efficiency, the demand for reliable and efficient auxiliary power units is likely to rise. This expansion of the aviation sector is a key driver for the US Aircraft Auxiliary Power Unit Market, indicating a robust future for APUs.

Increased Demand for Fuel Efficiency

The US Aircraft Auxiliary Power Unit Market is witnessing an increased demand for fuel efficiency, driven by rising fuel costs and the need for operational cost reduction. Airlines are under constant pressure to optimize their fuel consumption, and APUs play a crucial role in this endeavor. Modern APUs are designed to provide power to aircraft systems while minimizing fuel usage, thus contributing to overall fuel efficiency. According to industry reports, the implementation of advanced APU technologies can lead to fuel savings of up to 15% per flight. This growing emphasis on fuel efficiency is likely to propel the market forward, as operators seek to enhance their profitability and sustainability. Consequently, the US Aircraft Auxiliary Power Unit Market is expected to adapt and innovate in response to these evolving demands.

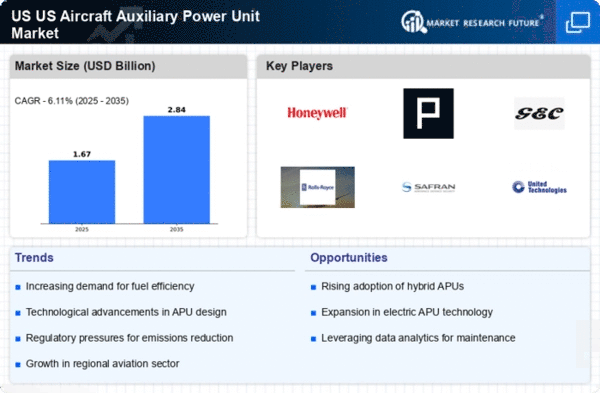

Technological Advancements in APU Design

The US Aircraft Auxiliary Power Unit Market is experiencing a notable transformation due to rapid technological advancements in APU design. Innovations such as improved fuel efficiency, reduced emissions, and enhanced reliability are becoming increasingly prevalent. For instance, the integration of advanced materials and manufacturing techniques has led to lighter and more efficient units. According to recent data, the market for APUs is projected to grow at a compound annual growth rate (CAGR) of approximately 5% over the next five years. This growth is driven by the demand for more efficient aircraft operations and the need for reduced operational costs. As airlines and operators seek to optimize their fleets, the adoption of these advanced APUs is likely to become a key focus area, thereby propelling the US Aircraft Auxiliary Power Unit Market forward.

Shift Towards Electrification and Hybrid Systems

The US Aircraft Auxiliary Power Unit Market is undergoing a paradigm shift towards electrification and hybrid systems. This transition is driven by the aviation sector's need to reduce dependency on traditional fossil fuels and enhance operational efficiency. Electric and hybrid APUs offer several advantages, including lower emissions, reduced noise levels, and improved fuel economy. Recent studies indicate that the adoption of electric APUs could potentially reduce fuel consumption by up to 30%. As airlines and manufacturers invest in research and development, the market is likely to see a surge in the availability of these innovative systems. This shift not only aligns with The Aircraft Auxiliary Power Unit Industry at the forefront of technological evolution in aviation.

Regulatory Compliance and Environmental Standards

The US Aircraft Auxiliary Power Unit Market is significantly influenced by stringent regulatory compliance and environmental standards. The Federal Aviation Administration (FAA) and the Environmental Protection Agency (EPA) have established regulations aimed at reducing aircraft emissions and noise pollution. These regulations compel manufacturers to innovate and develop APUs that meet or exceed these standards. As a result, there is a growing emphasis on the production of cleaner and quieter units. The market is witnessing a shift towards APUs that utilize sustainable technologies, such as alternative fuels and hybrid systems. This trend is expected to drive the market's growth, as airlines strive to comply with regulations while also enhancing their corporate social responsibility initiatives. The increasing focus on sustainability is likely to shape the future landscape of the US Aircraft Auxiliary Power Unit Market.