Growing E-Commerce Demand

The US Air Freight Software Market is experiencing a notable surge due to the increasing demand for e-commerce. As online shopping continues to expand, logistics companies are seeking efficient air freight solutions to meet consumer expectations for rapid delivery. In 2025, e-commerce sales in the US reached approximately 1 trillion USD, driving the need for advanced software that can streamline operations and enhance delivery speed. This trend is likely to persist, as consumers increasingly favor quick shipping options, thereby propelling the growth of air freight software solutions that facilitate real-time tracking and inventory management.

Technological Advancements in Logistics

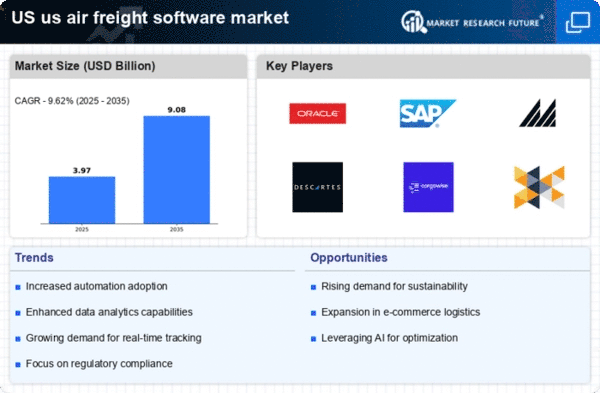

Technological innovations are significantly influencing the US Air Freight Software Market. The integration of advanced technologies such as artificial intelligence, machine learning, and blockchain is enhancing operational efficiency and transparency in air freight operations. For instance, AI-driven analytics can optimize route planning and reduce operational costs. The market for logistics technology is projected to grow at a compound annual growth rate (CAGR) of around 10% through 2026, indicating a robust demand for sophisticated air freight software that can leverage these advancements to improve service delivery and customer satisfaction.

Regulatory Compliance and Safety Standards

The US Air Freight Software Market is also driven by the need for compliance with stringent regulatory frameworks and safety standards. The Federal Aviation Administration (FAA) and the Transportation Security Administration (TSA) impose rigorous regulations on air freight operations, necessitating the adoption of software solutions that ensure compliance. Companies are increasingly investing in software that can automate compliance processes, thereby reducing the risk of penalties and enhancing operational reliability. This focus on regulatory adherence is expected to bolster the demand for air freight software that integrates compliance management features.

Increased Competition and Market Consolidation

The US Air Freight Software Market is characterized by heightened competition and ongoing market consolidation. As logistics providers strive to differentiate themselves, there is a growing demand for advanced software solutions that enhance service offerings and operational efficiency. Mergers and acquisitions within the logistics sector are becoming more common, leading to the integration of diverse software capabilities. This competitive landscape encourages innovation, as companies seek to leverage technology to gain a competitive edge. The trend of consolidation is expected to continue, further shaping the dynamics of the air freight software market.

Rising Fuel Costs and Sustainability Initiatives

The US Air Freight Software Market is influenced by rising fuel costs and a growing emphasis on sustainability. As fuel prices fluctuate, logistics companies are compelled to seek software solutions that optimize fuel efficiency and reduce operational costs. Furthermore, there is a heightened awareness of environmental impact, prompting companies to adopt sustainable practices. The market for green logistics is anticipated to grow, with software that supports carbon footprint tracking and sustainable route planning becoming increasingly essential. This dual focus on cost reduction and sustainability is likely to drive innovation in air freight software.