Military and Defense Applications

the aerospace high-performance-alloys market is significantly influenced by increased investments in military and defense applications. As nations prioritize national security, there is a growing demand for advanced materials that can withstand harsh environments and provide superior performance in military aircraft. High-performance alloys, such as titanium and nickel-based superalloys, are essential for developing next-generation fighter jets and unmanned aerial vehicles (UAVs). The U.S. Department of Defense has allocated substantial budgets for research and development in aerospace technologies, which is likely to bolster the demand for high-performance alloys. This focus on military applications not only drives innovation but also ensures a steady growth trajectory for the aerospace high-performance-alloys market in the coming years.

Growth of the Commercial Aviation Sector

The expansion of the commercial aviation sector is a key driver for the aerospace high-performance-alloys market. With increasing air travel demand, airlines are investing in new aircraft to enhance capacity and efficiency. This growth is reflected in the projected increase in global passenger numbers, which is expected to reach 8.2 billion by 2037. As airlines seek to improve fuel efficiency and reduce operational costs, the use of high-performance alloys in aircraft design becomes paramount. These materials not only contribute to weight reduction but also enhance the overall performance of aircraft. Consequently, the aerospace high-performance-alloys market is likely to experience substantial growth, driven by the rising need for advanced materials in new aircraft models.

Regulatory Compliance and Safety Standards

The aerospace high-performance-alloys market is significantly impacted by stringent regulatory compliance and safety standards imposed by aviation authorities. These regulations necessitate the use of high-performance materials that can withstand extreme conditions, such as high temperatures and corrosive environments. As manufacturers aim to meet these standards, the demand for advanced alloys that offer enhanced durability and reliability is likely to increase. For example, the Federal Aviation Administration (FAA) mandates rigorous testing and certification processes for materials used in aircraft manufacturing. This regulatory landscape not only drives innovation in alloy development but also ensures that the aerospace high-performance-alloys market remains robust, as companies invest in materials that comply with safety and performance requirements.

Increasing Demand for Lightweight Materials

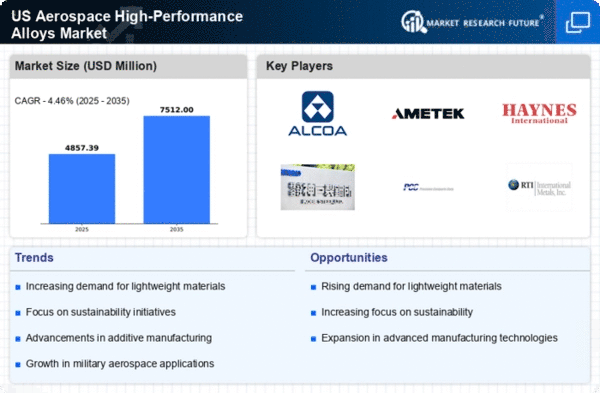

The aerospace high-performance-alloys market is experiencing a surge in demand for lightweight materials, driven by the need for fuel efficiency and reduced emissions in aircraft. As airlines and manufacturers strive to meet stringent environmental regulations, the adoption of high-performance alloys that offer superior strength-to-weight ratios becomes essential. For instance, titanium and aluminum alloys are increasingly favored for their ability to enhance performance while minimizing weight. This trend is reflected in the projected growth of the aerospace sector, which is expected to reach $1 trillion by 2030, further propelling the demand for advanced materials. Consequently, The aerospace high-performance-alloys market is likely to benefit from this shift towards lightweight solutions. Manufacturers are seeking to optimize aircraft design and operational efficiency.

Technological Innovations in Alloy Production

Technological advancements in the production of high-performance alloys are significantly influencing the aerospace high-performance-alloys market. Innovations such as vacuum melting and advanced casting techniques are enhancing the quality and performance of alloys, making them more suitable for aerospace applications. These technologies not only improve the mechanical properties of the materials but also reduce production costs, which is crucial in a competitive market. The introduction of new alloy compositions, such as nickel-based superalloys, is also expanding the range of applications in aerospace engines and structural components. As a result, the aerospace high-performance-alloys market is poised for growth, with an estimated CAGR of 5.5% over the next five years, driven by these technological advancements.