Emergence of Smart Aircraft Technologies

The emergence of smart aircraft technologies is driving growth in the aerospace big-data-analytics market. These technologies, which include connected systems and advanced sensors, generate vast amounts of data that require sophisticated analytics for effective utilization. Smart aircraft are designed to optimize performance, enhance safety, and improve passenger experiences. As airlines and manufacturers adopt these technologies, the demand for analytics solutions that can process and interpret this data is expected to rise. The aerospace big-data-analytics market is likely to see a significant uptick in demand for analytics tools that can handle the complexities of smart aircraft data. This trend not only supports operational efficiency but also aligns with the industry's push towards more sustainable aviation practices.

Growing Demand for Operational Efficiency

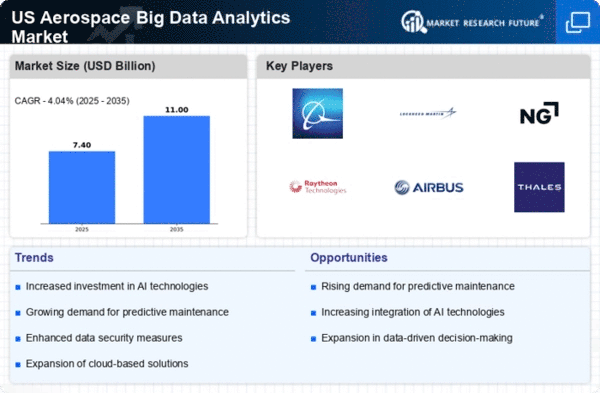

The aerospace big-data-analytics market is experiencing a surge in demand for operational efficiency across various sectors. Companies are increasingly leveraging data analytics to optimize flight operations, reduce fuel consumption, and enhance maintenance schedules. According to industry reports, the market is projected to grow at a CAGR of approximately 15% from 2025 to 2030. This growth is driven by the need for airlines and manufacturers to minimize costs while maximizing performance. By utilizing advanced analytics, organizations can identify inefficiencies and implement data-driven strategies that lead to significant savings. The aerospace big-data-analytics market is thus positioned to play a crucial role in transforming operational practices, ensuring that stakeholders remain competitive in a rapidly evolving landscape.

Advancements in Machine Learning Technologies

The aerospace big-data-analytics market is significantly influenced by advancements in machine learning technologies. These innovations enable more sophisticated data analysis, allowing for improved predictive maintenance and operational insights. Machine learning algorithms can analyze vast datasets to identify patterns and anomalies, which can lead to proactive decision-making. As organizations in the aerospace sector increasingly adopt these technologies, the market is expected to expand. Reports indicate that the integration of machine learning could enhance predictive capabilities by up to 30%, thereby reducing downtime and maintenance costs. The aerospace big-data-analytics market is thus poised to benefit from these technological advancements, which promise to revolutionize data utilization in aviation.

Regulatory Compliance and Safety Enhancements

Regulatory compliance is a critical driver for the aerospace big-data-analytics market. As safety regulations become more stringent, companies are compelled to adopt data analytics solutions to ensure compliance with federal aviation regulations. The Federal Aviation Administration (FAA) mandates rigorous reporting and analysis of flight data, which necessitates the use of advanced analytics tools. This trend is expected to propel the market, as organizations invest in technologies that facilitate real-time monitoring and reporting. The aerospace big-data-analytics market is likely to see increased investments in compliance-related analytics, which can enhance safety protocols and reduce the risk of accidents. This focus on safety not only protects passengers but also helps companies avoid costly penalties associated with non-compliance.

Increased Investment in Research and Development

Investment in research and development (R&D) is a pivotal driver for the aerospace big-data-analytics market. Companies are allocating substantial resources to explore innovative analytics solutions that can enhance operational capabilities and customer experiences. The aerospace sector is characterized by rapid technological advancements, and R&D plays a vital role in keeping pace with these changes. According to recent estimates, R&D spending in the aerospace industry is expected to reach $20 billion by 2026. This influx of investment is likely to foster the development of cutting-edge analytics tools that can provide deeper insights into operational data. The aerospace big-data-analytics market stands to gain from this trend, as enhanced R&D efforts lead to more effective data-driven strategies.