Emergence of IoT Applications

The proliferation of Internet of Things (IoT) devices is a significant driver for the 5g security market. As IoT applications expand across various sectors, including healthcare, manufacturing, and smart cities, the potential for security vulnerabilities increases. In 2025, it is anticipated that over 75 billion IoT devices will be operational globally, with a substantial portion located in the US. These devices often lack adequate security features, making them attractive targets for cybercriminals. The 5G security must evolve to address these challenges., leading to the development of specialized security solutions tailored for IoT environments. This shift is likely to result in a market growth rate of approximately 25% annually, reflecting the urgent need for comprehensive security frameworks.

Increased Regulatory Scrutiny

Regulatory bodies in the US are intensifying their focus on cybersecurity, particularly concerning 5G networks. New regulations and compliance requirements are emerging to ensure that organizations implement adequate security measures. The Federal Communications Commission (FCC) and other agencies are actively working to establish guidelines that govern the security of 5G infrastructure. This regulatory landscape is expected to drive investments in the 5g security market, as companies seek to comply with evolving standards. By 2026, it is projected that compliance-related expenditures will account for nearly 20% of total cybersecurity budgets in the telecommunications sector. This trend underscores the importance of regulatory compliance as a key driver for the growth of the 5g security market.

Growing Awareness of Cyber Threats

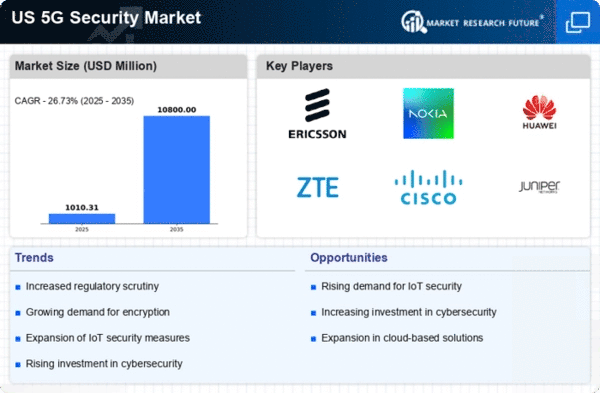

As cyber threats become more sophisticated, organizations are increasingly aware of the risks associated with 5G technology. High-profile data breaches and cyberattacks have heightened concerns about the security of mobile networks. In 2025, it is estimated that cybercrime will cost the global economy over $10 trillion annually, with a significant portion of these attacks targeting 5G networks. This growing awareness is prompting businesses to prioritize cybersecurity investments, thereby fueling the growth of the 5g security market. Companies are now more inclined to adopt advanced security solutions, including encryption and threat detection systems, to safeguard their networks. This shift in mindset is likely to contribute to a compound annual growth rate (CAGR) of 22% for the 5g security market over the next five years.

Rising Demand for Secure Connectivity

The increasing reliance on mobile networks for critical applications drives the demand for robust security measures in the 5g security market. As businesses and consumers adopt 5G technology, the need for secure connectivity becomes paramount. In 2025, it is estimated that the number of connected devices in the US will exceed 30 billion, creating a vast attack surface for cyber threats. This surge in connectivity necessitates advanced security protocols to protect sensitive data and maintain user trust. Consequently, organizations are investing heavily in security solutions, with the 5g security market projected to reach $12 billion by 2026. This trend indicates a strong correlation between the growth of 5G networks and the escalating need for enhanced security measures.

Technological Advancements in Security Solutions

The rapid evolution of technology is driving innovation in the 5g security market. Emerging technologies such as artificial intelligence (AI) and machine learning (ML) are being integrated into security solutions to enhance threat detection and response capabilities. These advancements enable organizations to proactively identify vulnerabilities and mitigate risks associated with 5G networks. In 2025, it is projected that AI-driven security solutions will account for approximately 30% of the total market share in the 5g security market. This trend indicates a shift towards more intelligent and adaptive security measures, which are essential for addressing the complexities of modern cyber threats. As organizations seek to leverage these technologies, the demand for advanced security solutions is expected to rise significantly.