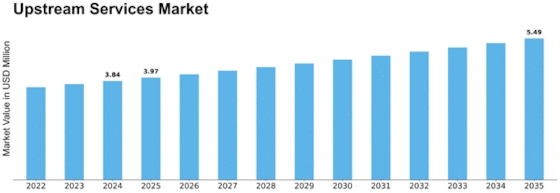

Upstream Services Size

Upstream Services Market Growth Projections and Opportunities

Influenced by global energy landscape, advancements in technology and changing strategies of exploration and production companies, the Upstream Services market is undergoing dynamic changes. Continuous search for new oil and gas reserves to meet the world's energy demands is among the leading forces shaping market dynamics. In order to discover and extract hydrocarbons efficiently, exploration and production (E&P) companies are constantly investing in upstream services. Consequently, as it can be observed from seismic surveys, drilling and reservoir evaluation among other types of upstream services where demand remains very strong due to a rising global population coupled with growing energy needs; this affects market dynamics positively.

The evolving dynamics of the Upstream Services market are deeply influenced by technological advancements. Innovations in exploration and drilling technologies such as 3D seismic imaging, advanced drilling techniques as well as real-time reservoir monitoring have increased efficiency and accuracy of upstream operations. These technological breakthroughs also help reduce exploration risks while improving overall recovery rates from oil and gas reservoirs thus driving adoption of advanced upstream services that shapes the market dynamic.

The fluctuation in oil and gas prices globally significantly influences the market dynamics of Upstream Services. Oil and gas prices directly impact profitability for E&P activities thereby affecting investment decisions by these companies. Similarly, during periods when oil prices soar, significant investments are made towards upstream services owing to their economic viability for extraction purposes whereas during times when oil prices slump there may be reduced levels of activity in exploration or production hence influencing market dynamics within upstream sector.

Moreover, designers focus on environmental sustainability has become an important factor influencing the market dynamics of Upstream Services towards cleaner sources of energy. While conventional oil & gas exploration still plays critical roles; the industry has increasingly become interested with unconventional resources like shale oils & gasses besides renewable energy explorations too. By offering both conventional and emerging energy aligned services in response to these changing needs that shape markets around a wider scope of ecological alternatives while accommodating the market dynamics of a broader energy mix.

The geopolitical landscape and regulatory changes are additional factors shaping the market dynamics of Upstream Services. Political decisions, trade tensions and regulatory frameworks may affect the investment climate for upstream activities. Changes in environmental standards, safety requirements and land access regulations may influence E&P companies’ operational strategies hence impacting on growth within this sector. In addition, geopolitical events such as realignment of global alliances or conflicts in oil-producing regions directly impact on upstream activities and growth of this industry.

Leave a Comment