Uninterruptible Power Supply Ups Size

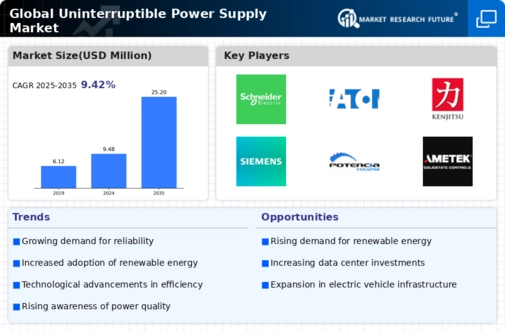

Uninterruptible Power Supply UPS Market Growth Projections and Opportunities

The burgeoning demand for IoT (Internet of Things) devices has propelled the anticipation of imminent commercialization of Uninterruptible Power Supply (UPS) systems. The market is witnessing a surge in cost-efficient UPS variants like offline/standby and line-interactive UPS systems, fostering their adoption across diverse industry segments such as data centers, medical facilities, retail outlets, industrial settings, and telecommunication applications. Serving as an alternative power source, UPS systems are crucial for powering electronic devices in the absence of a primary power supply, comprising electronic components like converters, switches, and energy storage devices (e.g., batteries) that offer backup power during outages. Their primary benefits lie in shielding computers and systems from power interruptions and outages.

The increasing demand for high-quality and efficient UPS systems, ensuring uninterrupted power supply, is witnessing a substantial rise across various business applications. Countries such as China, India, South Africa, and other emerging economies are grappling with power supply issues, emphasizing the critical need for sustained power during peak hours. Consequently, the significance of superior UPS systems is amplifying in commercial and residential areas located remotely from power grid stations. Moreover, safeguarding connected devices from frequent power fluctuations is emerging as a pivotal factor propelling market growth.

Nevertheless, the high maintenance costs associated with UPS systems pose a challenge to market growth. Businesses are seeking cost-effective solutions to address their operational requirements, considering the substantial maintenance costs linked to UPS systems, primarily determined by battery lifespans. In response, companies are innovating and developing cost-efficient solutions to lower operational expenses and mitigate these concerns.

According to analysis by MRFR (Market Research Future), key global players in the UPS systems domain include Schneider Electric (France), Eaton Corporation (Ireland), Emerson Electric (US), ABB (Switzerland), Socomec (France), Toshiba Corporation (Japan), AEG Power Solutions (US), Kehua (China), Kstar Corporation (China), and Beijing Dynamic Power Co. Ltd. (China). These industry leaders have adopted various strategies, encompassing organic and inorganic growth methodologies such as product development, partnerships, collaborations, mergers, and acquisitions. These initiatives aim to broaden their product portfolios and fortify their foothold in the UPS market, ensuring a competitive edge in the industry.

Leave a Comment