Ultra Wideband Size

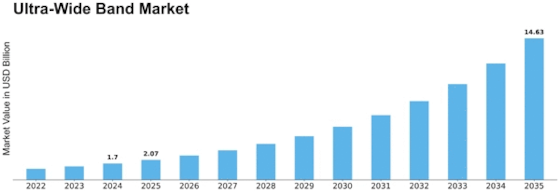

Ultra WideBand Market Growth Projections and Opportunities

The elements and development direction of the Ultra-Wide Band (UWB) market are altogether formed by a wealth of affecting variables. A fundamental determinant of the market is the heightening requirement for fast information transmission and cooperation across assorted areas. With the rising interest in remote correspondence arrangements that are both quicker and more effective, UWB innovation arises as a promising choice.

This innovation gives significant information transmission rates while keeping a low power utilization. Moreover, administrative drives essentially affect the design of the UWB market. Principles and rules relating to UWB gadgets are effectively evolved by states and administrative bodies overall to ensure their interoperability and productive organization. Adherence to these guidelines is basic for market members to lay out believability and develop a climate that is ideal for the execution of UWB innovation.

Moreover, the consolidation of UWB innovation into different applications invigorates market development. Boundless utilizations of UWB's abilities incorporate the improvement of ongoing resource checking frameworks and exact area following in indoor conditions; Manufacturing, healthcare, the automotive industry, and logistics are just a few examples. Because of its flexibility, UWB is an important innovation that can be used to address specific necessities in different ventures, subsequently growing its market presence. Moreover, the serious climate is a significant variable that influences the UWB market. Central participant interest in innovative work tries pointed toward further developing UWB innovation animates advancement and moves market development. Joint efforts and associations among industry members cultivate a climate that is both serious and agreeable, accordingly speeding up the turn of events and commercialization of UWB arrangements. Furthermore, mechanical improvements impact the UWB market by presenting novel open doors and applications. The mix of highlights, for example, upgraded security, further developed precision in area-based administrations, and similarity with arising correspondence guidelines improves the allure of UWB for organizations and purchasers the same as it keeps on creating.

The never-ending advancement of the market guarantees that it stays dynamic and versatile to the constantly moving requests of the computerized age. Moreover, purchaser inclinations and patterns impact the UWB market. The interest in UWB-empowered items is affected by the growing use of shrewd gadgets, IoT (Web of Things) arrangements, and the rising importance put on continuous network. Buyers, especially corresponding to wearable gadgets and shrewd homes, want trustworthy and quick correspondence options. UWB is positioned as the preferred technology to meet these requirements. Also, the worldwide financial climate applies effect on the improvement of the UWB market. Speculation patterns, buying power, and the overall soundness of critical businesses are monetary determinants that influence the pace of UWB innovation reception. Advanced technologies like UWB can be readily adopted in a stable and expanding economic business environment to maintain a competitive edge and satisfy shifting consumer preferences.

Leave a Comment