Uk Processed Eggs Size

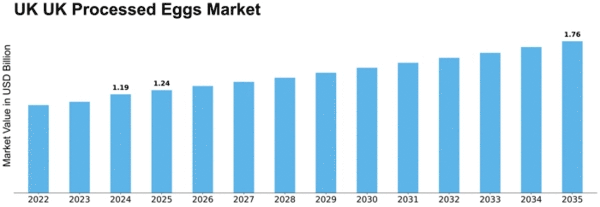

UK Processed Eggs Market Growth Projections and Opportunities

The UK processed eggs market is influenced by a variety of factors that collectively shape its growth and dynamics. One of the primary drivers is the convenience and versatility offered by processed eggs in various food applications. Processed eggs, including liquid eggs, powdered eggs, and pre-cooked eggs, provide a convenient solution for consumers and food manufacturers, saving time and effort in food preparation. The demand for quick and easy meal options has contributed to the steady growth of the processed eggs market in the UK, as consumers seek convenient and ready-to-use egg products.

Changing consumer preferences and dietary habits also play a crucial role in shaping the UK processed eggs market. With a growing focus on protein-rich diets and the recognition of eggs as a valuable source of protein, processed egg products have gained popularity. The versatility of processed eggs in both sweet and savory dishes, along with their extended shelf life, appeals to consumers looking for healthy and convenient protein options. This shift in consumer preferences towards healthier and protein-packed foods has positively influenced the demand for processed eggs.

The food industry's emphasis on product innovation and convenience further contributes to the market trends in the UK processed eggs segment. Manufacturers are continually developing new and innovative processed egg products, such as pre-made omelets, egg-based snacks, and protein-rich breakfast options. These innovations cater to the evolving tastes and preferences of consumers, enhancing the market's overall growth and expanding the range of processed egg offerings available in the market.

Supply chain dynamics, including egg production, processing facilities, and distribution networks, significantly impact the UK processed eggs market. The availability of high-quality eggs, efficient processing facilities, and reliable distribution channels are crucial for meeting consumer demand. Changes in egg production practices, such as cage-free or organic egg production, can influence the sourcing and pricing of eggs used in processed egg products. Market participants need to navigate these supply chain complexities to ensure a stable and reliable source of raw materials for processed eggs.

Regulatory considerations and quality standards also play a vital role in the processed eggs market. Stringent regulations govern food safety, labeling, and production practices in the UK. Compliance with these standards is essential for building consumer trust and ensuring the safety and quality of processed egg products. Companies that prioritize and communicate their adherence to these regulations often establish a positive brand image, gaining a competitive edge in the market.

Economic conditions and consumer purchasing power contribute to market dynamics. In periods of economic stability, consumers may be more willing to spend on convenient and premium processed egg products. Conversely, during economic downturns, there may be a shift towards more cost-conscious choices. Market participants need to consider these economic dynamics and adjust pricing strategies and product offerings accordingly.

The impact of sustainability and ethical considerations is increasingly influencing consumer choices in the UK processed eggs market. Consumers are more conscious of the environmental and ethical aspects of food production, leading to a preference for products with sustainable and humane sourcing practices. Companies adopting eco-friendly packaging, ethical sourcing of eggs, and transparent supply chain practices may attract consumers who prioritize sustainability, contributing to market growth.

Distribution channels and retail partnerships are critical elements in the UK processed eggs market. The accessibility of processed egg products through supermarkets, convenience stores, and online platforms impacts consumer reach and market penetration. Collaborations with retailers and effective distribution strategies contribute to the visibility and availability of processed eggs, influencing purchasing decisions and brand loyalty.

Leave a Comment