Growth of Plant-Based Diets

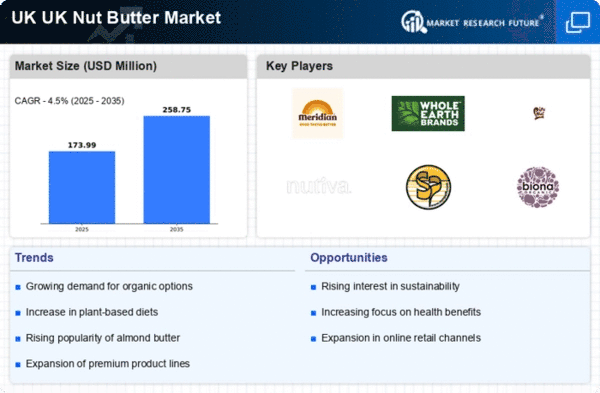

The rise of plant-based diets in the UK is another influential driver for the UK Nut Butters Market. As more consumers adopt vegetarian and vegan lifestyles, the demand for plant-based protein sources has surged. Nut butters, being rich in protein and essential nutrients, are increasingly viewed as a staple in plant-based diets. Market data indicates that sales of nut butters have grown substantially, with almond and peanut butters leading the charge. This trend suggests that the UK Nut Butters Market may continue to expand as more individuals seek convenient and nutritious options that fit their dietary preferences, potentially leading to increased product variety and innovation.

Innovative Product Development

Innovative product development is a crucial driver for the UK Nut Butters Market. As consumer preferences evolve, brands are compelled to introduce new flavors, textures, and formulations to attract a diverse customer base. The introduction of nut butter blends, such as those combining different nuts or incorporating superfoods, has gained traction. Market analysis indicates that unique flavor profiles and functional ingredients are becoming increasingly popular among UK consumers. This trend suggests that the UK Nut Butters Market is likely to witness a surge in creativity and experimentation, potentially leading to the emergence of niche products that cater to specific dietary needs and preferences.

E-commerce and Online Retail Growth

The rapid growth of e-commerce and online retail channels is transforming the UK Nut Butters Market. With the convenience of online shopping, consumers are increasingly purchasing nut butters through digital platforms. Recent statistics reveal that online grocery sales have surged, with a significant portion attributed to health food products, including nut butters. This shift not only broadens the market reach for brands but also allows for greater consumer access to a diverse range of products. As the UK Nut Butters Market adapts to this trend, companies may invest in digital marketing strategies and enhance their online presence to capture the growing segment of online shoppers.

Health Consciousness Among Consumers

The increasing health consciousness among consumers in the UK is a pivotal driver for the UK Nut Butters Market. As individuals become more aware of the nutritional benefits of nut butters, such as high protein content and healthy fats, demand is likely to rise. According to recent surveys, a significant percentage of UK consumers prioritize health and wellness in their dietary choices. This trend is reflected in the growing sales of natural and organic nut butters, which have seen a notable increase in market share. The UK Nut Butters Market is thus experiencing a shift towards products that align with health-oriented lifestyles, potentially leading to innovations in formulations and packaging that emphasize nutritional benefits.

Sustainability and Environmental Awareness

Sustainability and environmental awareness are becoming increasingly significant drivers for the UK Nut Butters Market. Consumers are more inclined to support brands that prioritize eco-friendly practices and sustainable sourcing of ingredients. This shift is evident in the growing demand for nut butters that are certified organic or sourced from sustainable farms. Market data indicates that products with transparent supply chains and environmentally responsible packaging are gaining popularity among UK consumers. As the UK Nut Butters Market responds to these consumer expectations, brands may focus on enhancing their sustainability initiatives, which could lead to a competitive advantage in a market that values ethical consumption.