Rising Demand for Biopharmaceuticals

The life science-analytical-instruments market is experiencing a notable surge in demand driven by the increasing focus on biopharmaceuticals. As the UK healthcare sector shifts towards biologics, analytical instruments play a crucial role in drug development and quality control. The biopharmaceutical market in the UK is projected to reach £25 billion by 2026, necessitating advanced analytical tools for research and production. This trend is likely to propel the demand for sophisticated instruments that ensure compliance with regulatory standards, thereby enhancing the growth of the life science-analytical-instruments market.

Emergence of Advanced Analytical Techniques

The emergence of advanced analytical techniques is reshaping the landscape of the life science-analytical-instruments market. Techniques such as mass spectrometry, chromatography, and next-generation sequencing are becoming increasingly prevalent in laboratories across the UK. These technologies enable more precise and efficient analysis of biological samples, which is essential for research and clinical applications. The adoption of these advanced methods is expected to drive market growth, as they enhance the capabilities of laboratories to conduct complex analyses, thereby expanding the overall life science-analytical-instruments market.

Regulatory Compliance and Quality Assurance

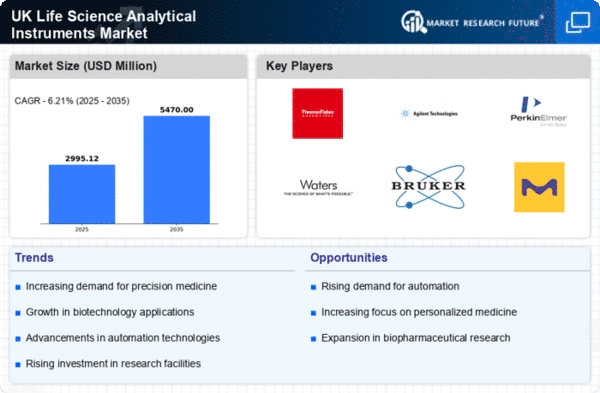

Regulatory compliance remains a pivotal driver for the life science-analytical-instruments market. The UK government and regulatory bodies impose stringent guidelines to ensure the safety and efficacy of medical products. As a result, laboratories and manufacturers are increasingly investing in advanced analytical instruments to meet these requirements. The market for analytical instruments is expected to grow at a CAGR of 6.5% through 2027, largely due to the need for quality assurance in pharmaceutical and biotechnology sectors. This emphasis on compliance is likely to sustain the growth trajectory of the life science-analytical-instruments market.

Growing Focus on Environmental Sustainability

The growing emphasis on environmental sustainability is influencing the life science-analytical-instruments market. As the UK moves towards greener practices, there is a rising demand for analytical instruments that minimize environmental impact. Manufacturers are increasingly developing eco-friendly instruments that comply with sustainability standards. This shift not only addresses regulatory pressures but also aligns with the values of consumers and stakeholders. The life science-analytical-instruments market is likely to benefit from this trend, as companies that prioritize sustainability may gain a competitive edge in the marketplace.

Increased Investment in Research and Development

Investment in research and development (R&D) is a significant driver for the life science-analytical-instruments market. The UK government has committed substantial funding to support scientific research, particularly in life sciences. In 2025, R&D expenditure in the UK is anticipated to reach £45 billion, fostering innovation and the development of new analytical technologies. This influx of funding is likely to stimulate demand for advanced analytical instruments, as researchers require cutting-edge tools to conduct experiments and validate findings. Consequently, the life science-analytical-instruments market is poised for robust growth.