Health and Wellness Trends

The frozen pizza market in the UK is increasingly influenced by health and wellness trends, as consumers become more conscious of their dietary choices. There is a growing demand for healthier frozen pizza options, including those that are gluten-free, low-calorie, or made with organic ingredients. Data indicates that the market for health-oriented frozen foods has expanded by approximately 25% in recent years, reflecting a shift in consumer priorities. This trend suggests that manufacturers in the frozen pizza market must adapt their product lines to include healthier alternatives to meet the evolving needs of health-conscious consumers. As this segment continues to grow, it may significantly impact the overall dynamics of the frozen pizza market.

Convenience and Time-Saving

The frozen pizza market in the UK is experiencing a surge in demand driven by the increasing need for convenience among consumers. Busy lifestyles and the growing trend of on-the-go meals have led to a preference for quick meal solutions. According to recent data, approximately 60% of UK households report that they regularly purchase frozen meals, with frozen pizza being a popular choice due to its ease of preparation. This trend indicates that consumers are prioritizing time-saving options, which is likely to continue influencing the frozen pizza market. As more individuals seek hassle-free dining experiences, the industry is expected to adapt by offering a wider variety of frozen pizza options that cater to this demand for convenience.

Innovative Flavour Profiles

The frozen pizza market in the UK is witnessing a notable shift towards innovative flavour profiles, reflecting changing consumer preferences. As palates become more adventurous, manufacturers are introducing unique toppings and combinations that appeal to a broader audience. Recent market analysis suggests that around 30% of consumers are willing to try new and exotic flavours, which has prompted brands to experiment with gourmet ingredients and international cuisines. This trend not only enhances the appeal of frozen pizzas but also positions the industry to capture a larger share of the market. By embracing creativity in flavour offerings, the frozen pizza market is likely to attract a diverse customer base, thereby driving growth.

Expansion of Retail Channels

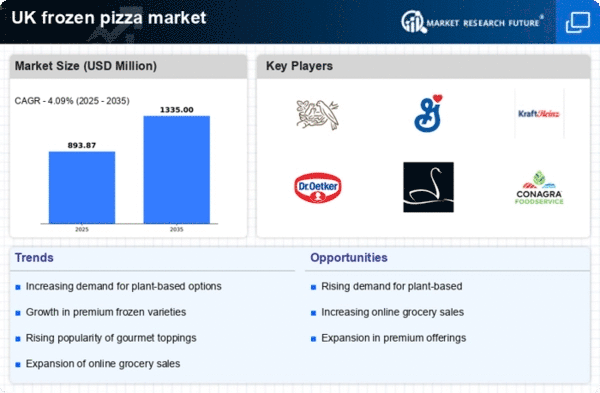

The frozen pizza market in the UK is benefiting from the expansion of retail channels, which enhances accessibility for consumers. The rise of online grocery shopping and the proliferation of convenience stores have made frozen pizzas more readily available to a wider audience. Recent statistics show that online grocery sales have increased by approximately 20% in the past year, indicating a shift in shopping habits. This expansion allows consumers to easily access a variety of frozen pizza options, catering to diverse tastes and preferences. As retail channels continue to evolve, the frozen pizza market is likely to see increased sales and a broader customer base, further driving industry growth.

Sustainability and Ethical Sourcing

The frozen pizza market in the UK is increasingly shaped by consumer demand for sustainability and ethical sourcing practices. As awareness of environmental issues rises, consumers are seeking products that align with their values, including those that utilize responsibly sourced ingredients and eco-friendly packaging. Recent surveys indicate that over 40% of UK consumers are willing to pay a premium for products that are sustainably produced. This trend is prompting manufacturers in the frozen pizza market to adopt more sustainable practices, which could enhance brand loyalty and attract environmentally conscious consumers. The emphasis on sustainability is likely to become a defining characteristic of the industry, influencing purchasing decisions and market growth.

Leave a Comment