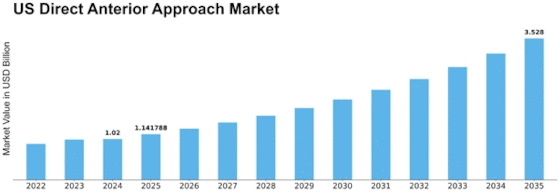

U S Direct Anterior Approach Size

U.S. Direct Anterior Approach Market Growth Projections and Opportunities

The US Direct Anterior Approach (DAA) market, a significant sector within the orthopedic and surgical field, is characterized by diverse market share positioning strategies as companies aim to capitalize on the demand for innovative hip replacement techniques. A pivotal strategy in this landscape is product differentiation, where orthopedic companies focus on refining and advancing their DAA procedures. This may involve the development of specialized surgical instruments, enhanced implants, or advanced navigational technologies to optimize the surgical process. By offering unique and advanced solutions, companies seek to stand out in a competitive market, positioning themselves as leaders in providing state-of-the-art DAA procedures for hip replacements.

Cost leadership is another critical strategy in the US DAA market, recognizing the importance of affordability and accessibility in healthcare solutions. Companies strive to optimize the costs associated with DAA surgeries without compromising quality. This entails streamlining surgical processes, negotiating favorable agreements with suppliers, and adopting efficient technologies to make DAA procedures more cost-effective. By providing economically viable options, companies not only attract a broader patient base but also contribute to an increased market share in a healthcare landscape where cost considerations are paramount.

Market segmentation is a key aspect of strategic positioning within the US DAA market. Companies acknowledge the diversity in patient needs and surgical preferences and tailor their DAA procedures to address specific patient demographics or conditions. For instance, developing specialized DAA techniques for different age groups, addressing varying levels of hip degeneration, or catering to specific patient profiles allows companies to address niche markets more effectively. This targeted approach not only ensures that the DAA procedures align with the specific requirements of different patient groups but also enhances the overall market presence of these companies.

Strategic collaborations and partnerships play a vital role in the US DAA market, given the multidisciplinary nature of orthopedic surgeries. Companies often engage with orthopedic surgeons, medical institutions, and healthcare providers to enhance their understanding of DAA procedures, access valuable insights from clinical settings, and promote the adoption of their techniques. Collaborative efforts enable companies to stay at the forefront of orthopedic research and innovation, positioning themselves as leaders in the field and reinforcing their market share in the competitive landscape of DAA hip replacement surgeries.

Customer-centric strategies are paramount in the US DAA market, where patient satisfaction and outcomes are of utmost importance. Companies that prioritize patient education, provide clear information about the benefits and risks of DAA procedures, and ensure comprehensive pre- and post-operative support contribute to increased patient satisfaction and loyalty. Building strong relationships with healthcare providers through training programs and ongoing support not only enhances the adoption of DAA procedures but also positively influences the market share of companies offering these advanced orthopedic solutions.

Geographic expansion is a crucial element of market share positioning in the US DAA market. Companies often target regions with a high prevalence of hip-related conditions or where there is a growing demand for minimally invasive hip replacement techniques. Establishing a robust presence in key markets allows companies to adapt their DAA procedures to regional variations in healthcare practices and preferences, contributing to an increased market share on a national scale.

Leave a Comment