- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

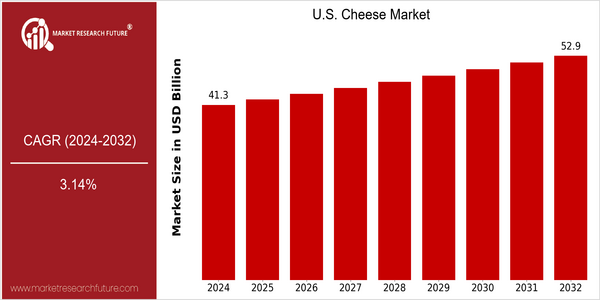

U.S. Cheese Market Size Snapshot

| Year | Value |

|---|---|

| 2024 | USD 41.31 Billion |

| 2032 | USD 52.92 Billion |

| CAGR (2024-2032) | 3.14 % |

Note – Market size depicts the revenue generated over the financial year

The cheese market is set to grow steadily, and is estimated to reach $47 billion by 2032. The CAGR of this market is 3.14 percent. This is largely due to the versatility of cheese in the kitchen and the rising demand for dairy products. The increasing popularity of snacking and the use of cheese in various foods are also contributing to the market’s growth. Also, improvements in cheese production, such as improved fermentation and better packaging, are enhancing product quality and shelf life, and thereby attracting a wider audience. The major players in the cheese market, such as Kraft Heinz, Lactalis Group, and Fonterra, are investing in new product launches and expansions in order to capitalize on these trends. These efforts are not only strengthening their market position, but are also contributing to the growth of the overall cheese market.

Regional Deep Dive

The United States cheese market is characterized by a wide variety of products and a strong consumer preference for both traditional and new varieties. The market is also influenced by the growing health consciousness, the rise of gourmet cheese and the growing popularity of plant-based alternatives. Each region is unique and has its own characteristics, which determine the overall picture of the cheese market in the United States.

North America

- The North American cheese market is experiencing a boom in the demand for artisan cheeses, driven by the growing popularity of gastronomic products. Kraft and Bel are expanding their product range to include special tastes and textures.

- In the USA, recent changes in regulations such as the labeling of dairy products, the introduction of the “Food and Drug Administration (FDA)”, have had a significant influence on the way cheese is marketed and viewed by consumers.

- The rise of the e-commerce platforms has transformed the distribution of cheeses, and companies like Murray’s Cheese are now using the Internet to reach a wider audience, thus catering to the growing trend of home cooking and gourmet dining.

Europe

- The cheese market is still a very important one, especially in Europe, where France and Italy are the most important producers and consumers of cheese. PDO cheeses are the most important, and the focus on PDO products is influencing consumers' preferences and driving up prices.

- It is no longer just a question of milk, but of milk-based products, rennets and lactases, whose use is now a matter of course. The demand for dairy products has a very long history, and has been nourished by the same milk as the rest of the dairy products.

- Culture, and the Mediterranean diet, still strongly influence the consumption of cheeses, which are now more and more appreciated with wines and other local delicacies.

Asia-Pacific

- The Asia-Pacific region is experiencing a rapid increase in cheese consumption, especially in China and Japan. Western diets are increasing the demand for both natural and processed cheeses.

- There are also many local companies, such as Mengniu Dairy and Yili Group, which are very popular in the local area, such as the local cheese, cheese and biscuits, etc., which are very popular with young people.

- The growing health consciousness of consumers has led to a shift to low-fat and functional cheese, which are enriched with pro- and vitamins.

MEA

- In the Near East and Africa, the cheese market is developing rapidly. The demand for imported cheeses, particularly from Europe, is growing as consumers seek the highest quality and most varied tastes.

- The milk-producers of the country are supplying the increasing demand for dairy products by developing new kinds of cheese such as labneh and halloumi. The export of these products is also growing.

- Governments are becoming more supportive of dairy production, and new initiatives to improve food safety standards and support local dairy industries will help to stimulate growth in the market.

Latin America

- In Latin America the market is dominated by fresh and soft cheeses, and in countries like Mexico and Brazil the leading brands are Tia Rosa and La Vaquita.

- The last few years have seen a resurgence in interest in gourmet and artisan cheeses. Various local producers have been experimenting with flavours and aging techniques to entice more discerning consumers.

- The increase in the consumption of cheese is largely due to economic reasons, such as the increase in the purchasing power of the population and the urbanization of the country, especially among the younger generations, who are increasingly exploring international cuisines and gourmet products.

Did You Know?

“The United States is the world's greatest producer of cheese, with 1,400 varieties, each a rich treasury of gastronomic delights.” — U.S. Department of Agriculture (USDA)

Segmental Market Size

The United States market for cheese is characterized by a wide range of segments, with the specialty cheeses segment showing the most growth. The specialty cheeses segment is growing because of the increasing interest in gourmet and artisanal products, which is driven by the search for unique flavors and high-quality ingredients. The emergence of plant-based alternatives is also affecting consumers' preferences, forcing traditional cheese producers to innovate and diversify their products.

Demand is also being driven by the trend towards snacking, where cheese is an easy, nutritious option, and the growing popularity of cheese in gastronomic applications, such as gourmet cooking and food pairings. The current development stage of the specialty cheese market is mature, with Kraft Heinz and Bel Brands leading in innovation and penetration. Use cases include cheese boards in restaurants and cheese shops, which cater to the gourmet market. The development of macro trends, such as a focus on health and the pursuit of sustainable development, is accelerating the growth of the specialty cheese market. New fermentation processes and supply chain logistics are enhancing product quality and availability.

Future Outlook

US ARMY From 2024 to 2032, the cheese market will grow steadily, with a compound annual growth rate of 3.14%, from 41,31 million to 51,29 million. This growth is due to the growing demand for various types of cheese, the new trends in cuisine and the growing demand for gourmet and artisanal products. Health-conscious consumers are looking for cheese that is in line with their diet, such as low-fat cheese or plant-based alternatives. This will increase the penetration of the cheese market, especially in the younger generations, who are more interested in the quality and the sustainable origin of food.

This market is likely to be benefited by the introduction of improved fermentation and maturing processes. In addition, government initiatives to promote local dairy farming and sustainable practices will also boost the availability of high-quality cheeses. And finally, the growing popularity of cheese-and-beer pairing and the use of cheese in plant-based diets are also likely to influence the preferences of consumers. This will enable the market to grow and evolve in the coming years. This report studies the Cheese market.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2022 | USD 38.5 Billion |

| Market Size Value In 2023 | USD 39.88 Billion |

| Growth Rate | 3.60% (2023-2032) |

U.S. Cheese Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.