Market Trends

Key Emerging Trends in the Two-piece Empty Hard Capsule Market

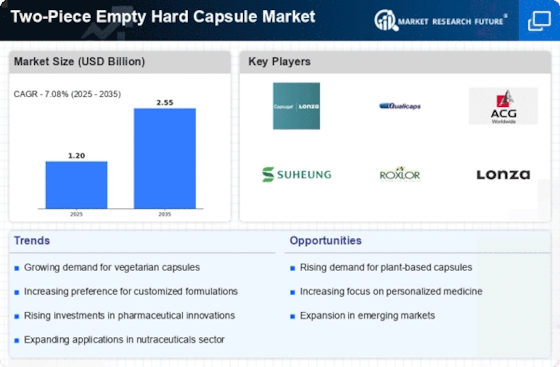

Big companies are putting more money into making capsules, especially the two-piece empty hard capsules that many people use for their medicines. This is happening because more and more people prefer taking medicines in capsule form. To keep up with the increasing demand, these major companies are investing a lot of money to build new places where they can make these capsules. For example, in August 2016, a company called ACG Worldwide spent 1.85 billion baht to build a capsule factory in Rayong, Thailand. Another company, Capsugel (which is now part of Lonza Company), invested over 25 million USD in March 2015 to make more vegetarian capsules. In February 2018, CapsCanada spent a whopping 28 million USD to expand its K-CAPS manufacturing capacity. By doing this, the company wanted to make more K-CAPS capsules to meet the growing demand all over the world.

People in the Middle East and Muslims in other places are increasingly looking for capsules that are certified as kosher or halal. This is because Gelatin, which is often used to make the shells of these capsules, is usually made from pork (pig-based), and consuming pork is not allowed in Islam. Because of this, there is a greater demand for capsules that have a kosher or halal certification. This trend is not limited to Muslims; even non-Muslim consumers are becoming more interested in high-quality, safe, and ethical products. Some companies, like Capsugel (now Lonza Company), make capsules like Vcaps Plus Capsules and Vcaps Capsules that are not only kosher- and halal-certified but also approved by the Vegetarian Society and Vegan Action in the US.

The use of two-piece empty hard capsules is not limited to medicines; it's also growing in the nutraceutical industry, which includes things like vitamins, antioxidants, and dietary supplements. Many well-known capsule manufacturers are creating capsules specifically for the pharmaceutical and nutraceutical industries. For instance, Capsugel (now Lonza Company) produces Coni-snap Sprinkle capsules that are designed for health and nutrition purposes. These capsules are meant for people who may have difficulty swallowing. The demand for nutraceutical products, which are used to prevent and treat diseases like Cardiovascular Diseases (CVD), is increasing. A study published in the International Journal of Preventive Medicine in 2014 suggests that combining nutraceuticals with physical exercises can help prevent and treat CVD. This growing demand for health-related products is contributing to the growth of the market for two-piece empty hard capsules.

Leave a Comment