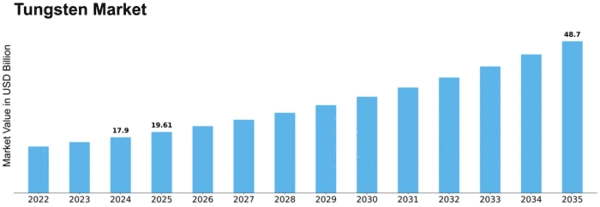

Tungsten Size

Tungsten Market Growth Projections and Opportunities

The tungsten market is influenced by several key factors that shape its dynamics and performance. One of the primary market factors affecting tungsten is global supply and demand dynamics. Tungsten is a critical metal used in various industries, including aerospace, automotive, electronics, and energy. The demand for tungsten is closely tied to economic growth, industrial production, and technological advancements. Emerging economies experiencing rapid industrialization and infrastructure development often drive increased demand for tungsten, while fluctuations in global economic conditions can impact demand levels.

Another significant factor affecting the tungsten market is geopolitical tensions and trade policies. Tungsten production is concentrated in a few countries, including China, Russia, and Vietnam, which collectively account for a significant portion of global supply. Any disruptions in production or trade tensions between major tungsten-producing nations can lead to supply shortages or fluctuations in prices. Additionally, trade policies, tariffs, and export restrictions imposed by governments can further influence the availability and pricing of tungsten in the global market.

Technological advancements and innovations also play a crucial role in shaping the tungsten market. As industries continue to evolve and demand higher-performing materials, there is a growing need for advanced tungsten alloys with improved properties such as strength, durability, and heat resistance. Research and development efforts focused on enhancing tungsten production processes, recycling technologies, and alloy formulations can drive market growth and create new opportunities for industry players.

The use of tungsten has increased because of its usage in the industries like X-ray tubes, bulb filaments, radiation shielding, superalloys, penetrating projectiles, gas tungsten arc welding are some of the industries which are the main reason for the growth of the tungsten market size.

Environmental and sustainability considerations are becoming increasingly important in the tungsten market. Tungsten mining and processing can have significant environmental impacts, including habitat destruction, water pollution, and carbon emissions. As awareness of environmental issues grows, stakeholders across the tungsten supply chain are under pressure to adopt sustainable practices, reduce their carbon footprint, and minimize environmental harm. This shift towards sustainability is driving investments in eco-friendly mining technologies, recycling initiatives, and responsible sourcing practices within the tungsten industry.

Market competition and industry consolidation also influence the dynamics of the tungsten market. With a limited number of major tungsten producers worldwide, competition for market share can be intense. Companies strive to differentiate themselves through product quality, innovation, and customer service while also seeking strategic partnerships and acquisitions to strengthen their position in the market. Mergers and acquisitions within the industry can lead to consolidation, impacting market concentration and supply chain dynamics.

Furthermore, currency fluctuations and macroeconomic factors can impact the tungsten market. Since tungsten is traded globally, changes in exchange rates can affect the competitiveness of tungsten-producing nations and the purchasing power of buyers. Additionally, macroeconomic indicators such as interest rates, inflation rates, and GDP growth can influence investor sentiment, commodity prices, and overall market demand for tungsten.

Leave a Comment