Trauma Fixation Devices Size

Trauma Fixation Devices Market Growth Projections and Opportunities

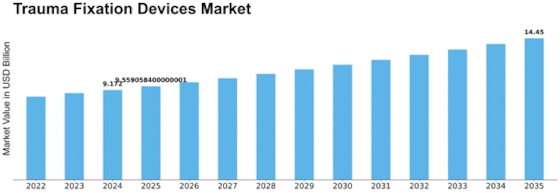

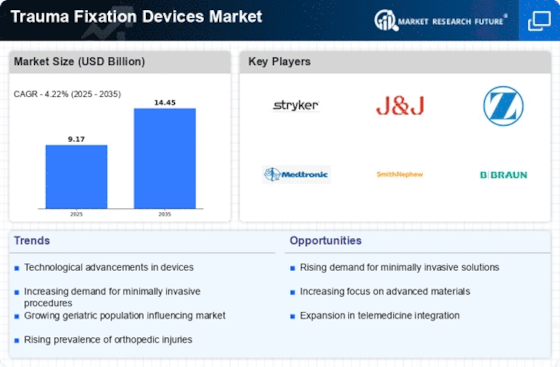

Trauma fixation devices Market volume is projected to attain USD 12.3 billion by 2032 at a CAGR of 4.22% throughout the anticipated period. Various factors work together to shape the dynamics of Trauma Fixation Devices market. Injuries, such as fractures and orthopedic traumas, are responsible for this situation which requires trauma fixation devices to stabilize bones during healing process.

Trauma care provision coupled with surgical procedure effectiveness is in high demand due to global population growth thus driving trauma fixation devices market up. This market owes much to the medical device industry specifically orthopedic and trauma surgery segments that have been continuously researching and developing innovative fixation technologies in this area. The entry of newly designed trauma fixation devices like plates, screws, intramedullary nails and external fixators on the other hand significantly affects it hence creating a competitive scenario among different medical device firms all aimed at providing advanced solutions that take into account patients’ interests.

The size of the Trauma Fixation Devices market is regulated by several factors with regulatory being paramount among them. Since these interventions involve life or death situations, there exist strict regulations put in place for approval purposes so as to ascertain effectiveness, safety, and quality of trauma fixation devices used during these surgeries. Thus adherence to regulatory guidelines is key especially when medical device companies want their products approved since healthcare professionals including doctors require confidence that these tools not only are reliable but also safe.

Economic aspects also play a role in the dynamics within the Trauma Fixation Devices market. Adoption of advanced fixation technologies differs across healthcare facilities depending on economic burden of traumatic injuries which includes; healthcare costs associated with managing them plus rehabilitation expenses and loss in productivity hours made by victims. Economic conditions; healthcare spending pattern and insurance dictate its growth also determine whether health providers can access cheap materials or latest technology regarding traumatic injuries.

Moreover technological advancements when it comes to design and material constitute another aspect shaping Trauma Fixation Devices market. Such changes in terms of materials like titanium and locking mechanisms have made it possible to produce durable, biocompatible and anatomic specific fixation devices. Other improvements such as minimally invasive surgery and computerized assisted navigation have boosted accuracy levels plus the pace at which trauma fixations are done. These devices have improved the surgical management of traumatic injuries hence are beneficial to patients.

Finally, the evolution occurring within trauma care alongside demand for personalized and patient-specific interventions impact on Trauma Fixation Devices market. They can be used to customize treatment modalities for fractures or individual patients’ anatomies that they are specifically designed for. Therefore, trauma fixation technologies remain an essential part of personalized medicine trend in health care whose goal is optimizing each surgery performed with respect to a specific patient’s condition.

Leave a Comment