Transparent Polyamides Size

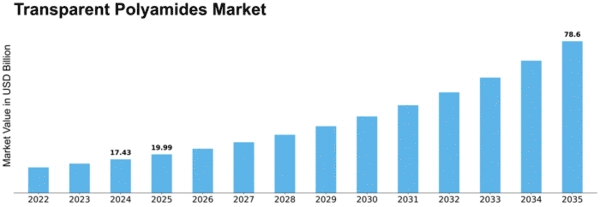

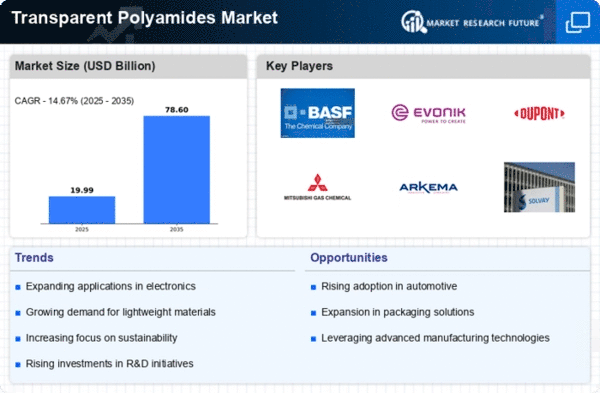

Transparent Polyamides Market Growth Projections and Opportunities

The Transparent Polyamides market has many factors, which determine the dynamics of this market. One of the key drivers for this is that there are numerous industries requiring transparent polyamides. These versatile polymers are used in various industries like automotive, packaging, electronics and consumer goods among others. In the growing automotive industry especially, transparent polyamides are being used to replace heavy metals with lightweight high-performance materials thus improving fuel efficiency as well as meeting sustainability goals.

In addition, technological advancements in the manufacturing processes of transparent polyamides significantly affect market growth. Ongoing R&D activities aimed at improving properties like transparency, tensile strength and thermal stability lead to innovations in the sector. Consequently, such innovations ensure industries remain competitive by addressing changing needs of clients.

Market trends are also determined by economic aspects. The prices of raw materials fluctuate including those of major ingredients essential for manufacturing transparent polyamide thereby affecting overall manufacturer’s cost structure. Factors like inflation rates, exchange rates and global trade policies impact on availability and costs of raw materials leading to unstable prices of raw materials which in turn affects Transparent Polyamides Market. For manufacturers to retain their competitiveness and profitability levels they have got to adjust themselves according to these economic variables.

Similarly, it can be said that this sector closely follows the general development of its end-user sectors. In particular, electronic devices and packaging sectors contributes a lot towards demand for clear amide products that can be seen across all areas. A rise in those sectors therefore necessitates advanced substances such as transparent amide products since they go hand in hand with each other. Thus, companies keenly follow performance indicators and expansion projects launched by key end-users so as to position optimally vis-à-vis emerging opportunities.

This indicates an environment where several substantial participants exist within Transparent Polyamides Market each seeking for more consolidation efforts. In accomplishment of this, many companies choose strategic collaborations or mergers and acquisitions. They are meant to broaden a product mix, increase an access to the market as well as getting competitive advantage. The formulated orientation is towards robust partnerships and alliances that bank on each other’s strengths to create a sustainable growth ecosystem.

Leave a Comment