Growing Geriatric Population

The increasing geriatric population is a significant factor driving the Tranquilizer Drugs Market. As individuals age, they often experience heightened levels of anxiety and other mental health issues, necessitating the use of tranquilizers for management. Data suggests that by 2030, the number of older adults is expected to reach 1.4 billion, creating a substantial market for tranquilizers tailored to this demographic. Additionally, the unique health considerations of older adults, such as polypharmacy and comorbidities, require specialized tranquilizer formulations. This demographic shift is likely to stimulate demand within the Tranquilizer Drugs Market, as healthcare providers seek effective solutions for managing anxiety and related disorders in older patients.

Advancements in Pharmaceutical Research

Innovations in pharmaceutical research are significantly influencing the Tranquilizer Drugs Market. The development of novel drug formulations, including extended-release and combination therapies, is enhancing the efficacy and safety profiles of tranquilizers. For instance, recent advancements have led to the introduction of drugs that target specific neurotransmitter systems, potentially reducing side effects associated with traditional tranquilizers. This evolution in drug development not only meets the needs of patients but also aligns with regulatory expectations for improved therapeutic outcomes. Consequently, the Tranquilizer Drugs Market is poised for growth as these advancements attract both healthcare providers and patients seeking more effective treatment options.

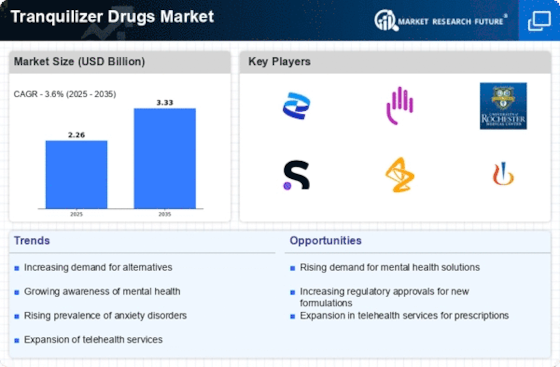

Increasing Prevalence of Anxiety Disorders

The rising incidence of anxiety disorders is a pivotal driver for the Tranquilizer Drugs Market. Recent studies indicate that approximately 18% of adults in various regions experience anxiety disorders, leading to a heightened demand for effective treatment options. This trend is likely to propel the market as healthcare providers increasingly prescribe tranquilizers to manage symptoms. Furthermore, the growing recognition of mental health issues has prompted healthcare systems to prioritize mental health care, thereby expanding the market for tranquilizers. As awareness continues to grow, the Tranquilizer Drugs Market is expected to witness substantial growth, driven by both the need for effective therapies and the increasing acceptance of mental health treatment.

Regulatory Support for Mental Health Treatments

The evolving regulatory landscape is fostering growth in the Tranquilizer Drugs Market. Governments and regulatory bodies are increasingly recognizing the importance of mental health treatments, leading to streamlined approval processes for new tranquilizer formulations. This supportive environment encourages pharmaceutical companies to invest in research and development, resulting in a wider array of tranquilizer options for patients. Additionally, regulatory initiatives aimed at promoting mental health awareness and treatment accessibility are likely to enhance market growth. As regulations become more favorable, the Tranquilizer Drugs Market is expected to expand, driven by the introduction of innovative products and increased patient access to necessary treatments.

Increased Accessibility to Mental Health Services

The expansion of mental health services is a crucial driver for the Tranquilizer Drugs Market. With the integration of mental health care into primary healthcare systems, access to treatment has improved significantly. Telehealth services and community-based programs are making it easier for individuals to seek help for anxiety and related disorders. This increased accessibility is likely to result in higher prescription rates for tranquilizers, as more patients are diagnosed and treated. Furthermore, initiatives aimed at reducing stigma surrounding mental health are encouraging individuals to pursue treatment, thereby further propelling the Tranquilizer Drugs Market. As mental health services continue to evolve, the demand for tranquilizers is expected to rise correspondingly.