Regulatory Compliance

Stringent regulations regarding vehicle emissions and safety standards are influencing the TPEE in Automotive Industry Market. Governments worldwide are implementing policies that require manufacturers to utilize materials that contribute to lower emissions and improved safety. TPEE, with its favorable properties, is increasingly being recognized as a suitable alternative to traditional materials. This regulatory landscape is expected to drive the adoption of TPEE, with market analysts projecting a potential increase in market size by 4% over the next few years as manufacturers seek compliance with evolving standards.

Technological Innovations

Technological advancements in automotive manufacturing processes are likely to propel the TPEE in Automotive Industry Market. Innovations such as 3D printing and advanced molding techniques enable manufacturers to utilize TPEE more efficiently, enhancing product performance and reducing waste. The integration of smart materials and sensors into automotive components is also gaining traction, suggesting a growing role for TPEE in high-tech applications. Market data indicates that the adoption of such technologies could increase the demand for TPEE by approximately 6% annually, reflecting a broader trend towards innovation in automotive materials.

Cost-Effectiveness of TPEE

The cost-effectiveness of TPEE is emerging as a crucial driver in the TPEE in Automotive Industry Market. As manufacturers seek to optimize production costs while maintaining quality, TPEE offers a competitive advantage due to its favorable pricing and performance characteristics. The material's durability and versatility allow for a wide range of applications, potentially reducing overall manufacturing expenses. Market data suggests that the adoption of TPEE could lead to a cost reduction of approximately 10% in certain automotive applications, making it an attractive option for manufacturers aiming to enhance profitability.

Sustainability Initiatives

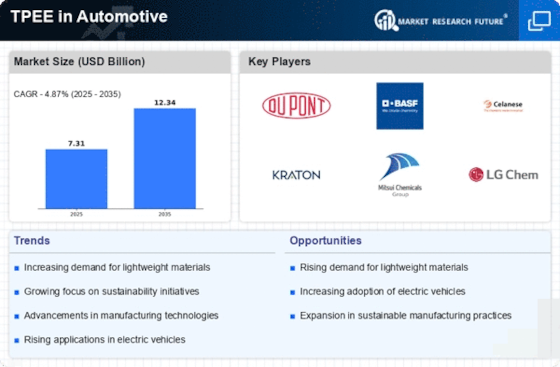

The increasing emphasis on sustainability within the automotive sector appears to drive the TPEE in Automotive Industry Market. Manufacturers are increasingly adopting eco-friendly materials to meet regulatory standards and consumer expectations. TPEE, known for its recyclability and reduced environmental impact, aligns well with these sustainability initiatives. As a result, the demand for TPEE is projected to rise, with estimates suggesting a compound annual growth rate of approximately 5% over the next five years. This trend indicates a shift towards more sustainable automotive solutions, potentially enhancing the market share of TPEE in the automotive industry.

Consumer Demand for Lightweight Materials

The growing consumer preference for lightweight vehicles is significantly impacting the TPEE in Automotive Industry Market. Lightweight materials contribute to improved fuel efficiency and enhanced vehicle performance, which are increasingly prioritized by consumers. TPEE, known for its lightweight characteristics, is becoming a preferred choice among manufacturers aiming to meet these consumer demands. Market Research Future indicates that the shift towards lightweight vehicles could result in a 7% increase in TPEE usage within the automotive sector, reflecting a broader trend towards efficiency and performance.