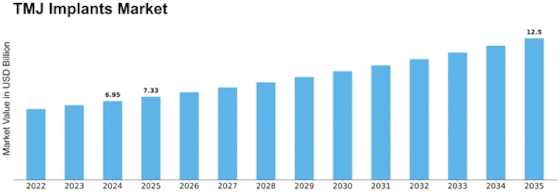

Tmj Implants Size

TMJ Implants Market Growth Projections and Opportunities

The TMJ (Temporomandibular Joint) implants market has seen some ups and downs between 2014 and 2018. During this time, there were some limitations that slowed down the growth of this market. However, things are looking up now!

Let's talk about the different parts of TMJ implants. The part called the mandibular component was a big player in the market, making up around 67.65% of the market share in 2020. And guess what? Experts think it's going to keep growing! By 2027, it's expected to be worth around USD 5,492.02 thousand. That's a big increase! This part is forecasted to grow by about 4.36% each year during this forecast period.

Now, there's another part called the screws segment. This part isn't as big as the mandibular component in terms of market share—it's about 2.40% in 2020. However, it's also expected to grow! It's projected to have a growth rate of about 4.13% each year.

So, what does all of this mean? It means that in the world of TMJ implants, the mandibular component is like the big player on the team. It's leading the way and is expected to keep growing a lot. On the other hand, the screws segment is smaller in terms of market share, but it's also making progress and is expected to increase in value over time.

Why are these implants important? Well, they're used for people who have problems with their temporomandibular joint, which is the joint that connects your jaw to your skull. When people have issues with this joint, it can cause pain or make it hard to open and close their mouths comfortably. TMJ implants help to fix these problems and improve people's quality of life.

The market for these implants might have faced some challenges in the past, but it's moving forward now. As more people become aware of these implants and the benefits they offer in fixing jaw problems, the demand for them is expected to rise.

The TMJ implants market is seeing growth, especially in the mandibular component part. This part is leading the market and is expected to keep growing steadily. Meanwhile, even though the screws segment is smaller, it's also making progress. Both parts play an important role in helping people with jaw issues, and their growth indicates a positive future for TMJ implant technology.

Leave a Comment