Titanium Ore Size

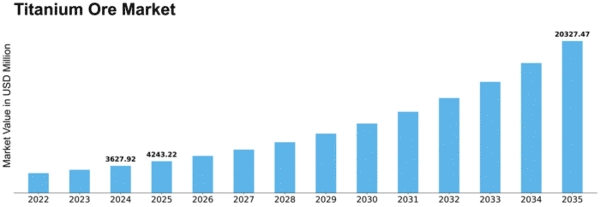

Titanium Ore Market Growth Projections and Opportunities

The titanium ore market is influenced by various factors that determine supply, demand, and pricing dynamics. One significant factor is the global demand for titanium, which is driven by its diverse applications in industries such as aerospace, automotive, chemical processing, and medical devices. As these industries grow and innovate, the demand for titanium and its ores increases. Additionally, the performance characteristics of titanium, such as its high strength-to-weight ratio, corrosion resistance, and biocompatibility, make it an attractive material for various applications, further driving demand.

Titanium ore is a mineral containing titanium metal in the form of compounds and concentrations. It is generated by the destruction of an altar with pwnhammer and can also be obtained by opening crates. Rutile and Ilmenite are the major sources of titanium ore. Ilmenite is used as the primary source for producing titanium metal after removing iron by chlorination process.

Supply-side factors also play a crucial role in shaping the titanium ore market. Titanium is primarily sourced from mineral deposits such as rutile, ilmenite, and leucoxene. The availability of these ores depends on geological factors, exploration efforts, and mining operations. Geological surveys and advancements in exploration technologies can lead to the discovery of new deposits, expanding the available supply of titanium ore. Conversely, geopolitical factors, environmental regulations, and operational challenges can disrupt mining operations and affect supply levels.

Technological advancements in mining and ore processing also influence the titanium ore market. Innovations in extraction techniques, such as advanced beneficiation processes and efficient separation methods, can enhance the productivity and cost-effectiveness of mining operations. Furthermore, research and development efforts focused on improving the recovery rates of titanium from low-grade ores or unconventional sources contribute to market dynamics by expanding the resource base and mitigating supply constraints.

Market dynamics are also influenced by macroeconomic factors such as economic growth, trade policies, and currency fluctuations. Strong economic growth and industrial expansion typically lead to increased demand for titanium and its ores, while economic downturns can dampen demand. Trade policies, tariffs, and trade agreements can affect the flow of titanium ore between countries, impacting market access and pricing. Moreover, currency fluctuations can influence the competitiveness of titanium ore exports and imports, affecting global market dynamics.

Environmental and sustainability considerations are increasingly shaping the titanium ore market. Environmental regulations, community concerns, and corporate sustainability goals drive the adoption of responsible mining practices and environmentally friendly technologies. Companies that demonstrate commitment to sustainability and ethical sourcing may gain a competitive advantage in the market, as consumers and investors prioritize environmentally responsible products and practices. Additionally, the growing emphasis on circular economy principles and resource efficiency encourages recycling and reuse of titanium-containing materials, reducing reliance on primary ore extraction.

Market sentiment and investor confidence also influence the titanium ore market. Factors such as geopolitical tensions, supply chain disruptions, and technological breakthroughs can trigger fluctuations in market prices and investment decisions. For instance, disruptions in the supply of key raw materials or geopolitical conflicts in major titanium-producing regions can lead to price volatility and supply shortages. On the other hand, technological innovations that improve production efficiency or expand the range of titanium applications can stimulate investment and market growth.

Leave a Comment