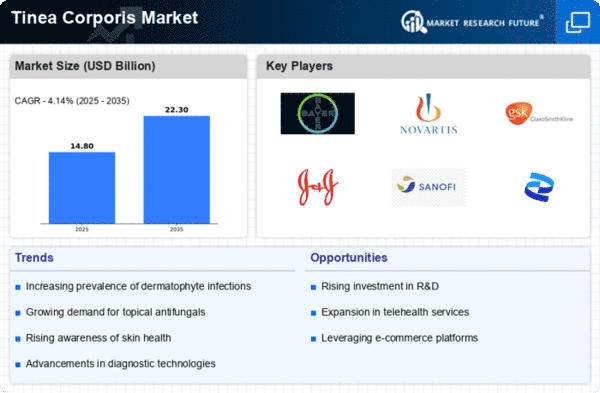

Tinea Corporis Size

Tinea Corporis Market Growth Projections and Opportunities

Tinea corporis pharmaceutical market refers to the special medical needs relating to Tinea Corporis, a common dermatophyte infection referred to as ringworm. The purpose of this market is to offer reliable and efficient pharmaceutical treatment for Tinea corporis which is basically a superficial fungal infection of the skin. This condition is characterized by itchy red rings on different parts of one’s body like on the necks calling for immediate attention since they are so uncomfortable.

The Pharmaceutical Market on Tinea Corporis is primarily based upon antifungal medications that provide both topical and systemic treatments regarding several etiologic agent’s fungi mostly belonging to Trichophyton or Microsporum species. For mild to moderate forms, topical antifungal creams, lotions or powders aim at eradicating surface fungi invading skin layers. Clotrimazole, miconazole or terbinafine are usually the main active components in these creams that hinder further proliferation.

Severe and chronic cases may necessitate use of systemic antifungal drugs including oral tablets or capsules which contain fluconazole or itraconazole as some of them. As such, these systemic therapies operate inside an individual’s system with respect to infections from ringworm which makes them complete therapeutically significant. Each case requires different treatment options; therefore, the importance of the Pharmaceutical Market on Tinea Corporis cannot be overemphasized.

Also, patient education and preventive measures should be emphasized on in pharmaceutical solutions for tinea corporis market. In order to prevent recurrence of tinea corporis proper hygiene practices, not sharing personal items as well as maintaining dry clean skin environment are essential. Nowadays, many pharma companies run awareness campaigns targeting early detection and prompt treatment.

Market challenges facing Pharmaceutical Tinea Corporis cases can be due to misdiagnosis or self-treatment thereby delaying appropriate pharmaceutical interventions. It reiterates that accurate diagnosis can only be achieved through consultation with health care professionals, who will then be able to plot individual medication plans for this challenge. Also, new antifungal medications and delivery methods are being developed to improve treatment efficiencies and patient compliance.

These are the reasons why the Pharmaceutical Market on Tinea Corporis is vital owing to its global nature; it can occur in any age-group or demographic globally. The prevalence of Tinea corporis depends on climate, living conditions and personal hygiene practices which varies between populations hence there are pharmaceutical solutions for diverse populations among different geographical areas.

Because the market is evolving continuous emphasis is placed on improving tolerability and convenience of antifungal treatments for tinea corporis. Consequently, developing soothing moisturizing formulations that contain other active ingredients such as antifungal agents aim at making patients comfortable during their course of therapy. This goes along with call by pharma industry towards patient centric approach where instead of focusing only on efficiency it also includes patient experience factors during medication process.

Leave a Comment