Tilt Sensor Size

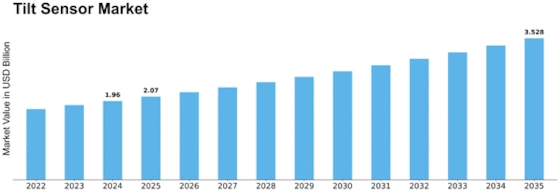

Tilt Sensor Market Growth Projections and Opportunities

Tilt sensors are important for keeping heavy construction equipment safe and preventing damage. Mining sensors help to avoid machine failure and protect equipment. These sensors can be integrated into existing plant infrastructure and are used for tracking, linear positioning, and improving the durability of vehicles used in mining and construction. Trolex is a company that specializes in developing sensors for mining and construction, which are used for monitoring humidity, air and gas, pressure, and other factors in these industries. Using a comprehensive series of sensors in mining and construction has been a key factor in their success. The increasing use of tilt sensors in mining and construction equipment is driving the overall growth of the market. As these sensors play a crucial role in preventing damage and machine failure, their adoption is becoming more widespread in the industry. By providing control systems for equipment and integrating with existing infrastructure, tilt sensors are enhancing safety and efficiency in mining and construction operations. Trolex's specialized sensors are designed to address the specific needs of heavy construction, making them a valuable asset in these sectors.

Tilt sensors are instrumental in heavy construction and mining industries, where the safety and efficiency of equipment are paramount. These sensors are used to prevent damage and potential machine failure, providing crucial support for the smooth operation of heavy machinery. By integrating tilt sensors into the existing infrastructure, companies can enhance their equipment control systems and ensure the safety of personnel and machinery. The increasing adoption of tilt sensors in mining and construction equipment is driving the growth of the market. As companies recognize the importance of these sensors in preventing damage and machine failure, the demand for reliable mining sensors is on the rise. The integration of tilt sensors into plant infrastructure and equipment control systems is enhancing the safety and performance of heavy construction and mining operations, making them an essential component of modern industrial practices.

Leave a Comment