Sustainability Initiatives

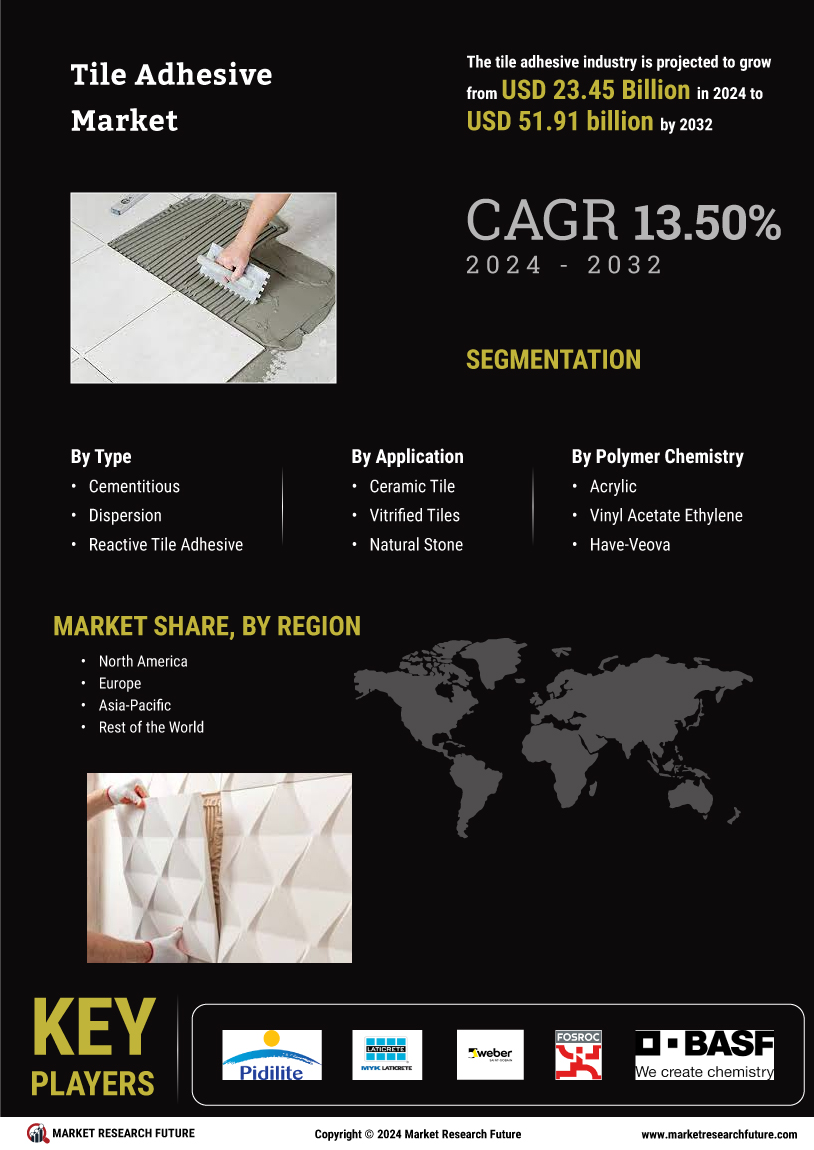

The Tile Adhesive Market is increasingly influenced by sustainability initiatives. As environmental concerns gain prominence, manufacturers are focusing on eco-friendly adhesive formulations. This shift is driven by regulatory pressures and consumer demand for sustainable products. For instance, the market for green building materials is projected to grow significantly, with tile adhesives being a key component. Companies are investing in research to develop adhesives that minimize environmental impact, such as those with low volatile organic compounds (VOCs). This trend not only aligns with global sustainability goals but also enhances brand reputation, potentially leading to increased market share in the Tile Adhesive Market.

Technological Advancements

Technological advancements play a crucial role in shaping the Tile Adhesive Market. Innovations in adhesive formulations and application techniques are enhancing performance characteristics, such as bond strength and curing time. For example, the introduction of polymer-modified adhesives has improved flexibility and durability, making them suitable for a variety of substrates. Additionally, automation in manufacturing processes is streamlining production, reducing costs, and improving product consistency. The integration of smart technologies, such as sensors for monitoring adhesive application, is also emerging. These advancements not only meet the evolving needs of consumers but also position companies competitively within the Tile Adhesive Market.

Expansion of Retail Channels

The Tile Adhesive Market is benefiting from the expansion of retail channels, which enhances product accessibility for consumers. The rise of e-commerce platforms and home improvement stores has made it easier for customers to purchase tile adhesives. This trend is particularly relevant as DIY projects gain popularity, with consumers increasingly opting for self-installation of tiles. Retailers are also offering a wider range of products, including specialized adhesives for different applications. This increased availability not only boosts sales but also encourages innovation within the Tile Adhesive Market, as companies strive to meet diverse consumer needs.

Rising Construction Activities

The Tile Adhesive Market is experiencing growth due to rising construction activities across various sectors. Urbanization and population growth are driving demand for residential and commercial buildings, which in turn increases the need for tile installations. According to recent data, the construction sector is expected to expand, with significant investments in infrastructure projects. This surge in construction activities directly correlates with the demand for tile adhesives, as they are essential for ensuring the durability and aesthetic appeal of tiled surfaces. Consequently, manufacturers in the Tile Adhesive Market are poised to benefit from this upward trend.

Increasing Demand for Aesthetic Solutions

The Tile Adhesive Market is witnessing an increasing demand for aesthetic solutions in interior and exterior design. Consumers are becoming more discerning about the visual appeal of their spaces, leading to a preference for high-quality tiles and adhesives that enhance overall aesthetics. This trend is particularly evident in the residential sector, where homeowners seek unique designs and finishes. As a result, manufacturers are developing specialized adhesives that cater to various tile types and applications, ensuring optimal performance while maintaining visual integrity. This focus on aesthetics is likely to drive growth in the Tile Adhesive Market.