Market Analysis

In-depth Analysis of Thrombus Treatment Market Industry Landscape

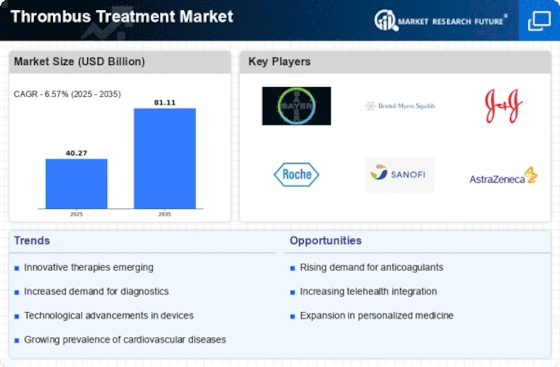

Market growth in the global thrombus treatment sector is significantly influenced by the introduction of new products, a process that involves major players investing in research and development (R&D). These key companies are consistently dedicating resources to create innovative and more effective products. Once these products undergo extensive R&D efforts and rigorous testing, they receive approval from regulatory bodies. A prime example of this is Johnson & Johnson (US), which, in December 2021, gained approval from the FDA (Food and Drug Administration) for XARELTO (rivaroxaban), a medication designed to treat blood clots in pediatric patients.

In addition to developing new treatment solutions, companies are also working on diagnostic products that can provide more accurate diagnoses of thrombosis. Sysmex Corporation (Japan), for instance, launched Automated Blood Coagulation Analyzers in July 2020. These analyzers are designed to accurately detect blood coagulation parameters, including molecular markers, all in a single device.

Furthermore, major players are expanding their capabilities by acquiring other companies in the field. An illustration of this is the acquisition made by Abbott Laboratories (US) in September 2021 when they acquired Walk Vascular, LLC (US). This strategic move aimed to enhance Abbott Laboratories' surgical capabilities, particularly in thrombectomy—a surgical procedure used to remove blood clots. Such initiatives undertaken by key players not only contribute to the development of novel and more efficient products but are also anticipated to drive further growth in the thrombus treatment market.

The cornerstone of market growth lies in the continual efforts of major players to innovate and introduce new products. These endeavors are often fueled by substantial investments in research and development. The goal is to bring forth treatments that are not only effective but also address specific needs within the healthcare landscape. Johnson & Johnson's achievement in gaining FDA approval for XARELTO, particularly for treating blood clots in pediatric patients, exemplifies the successful outcome of such dedicated R&D initiatives.

Beyond therapeutic interventions, there is a parallel focus on diagnostic tools to enhance the accuracy of thrombosis diagnoses. Sysmex Corporation's Automated Blood Coagulation Analyzers, introduced in July 2020, mark a notable advancement in this regard. The analyzers offer a comprehensive approach by accurately detecting various blood coagulation parameters and molecular markers. This innovation is poised to improve the diagnostic process and subsequently contribute to more targeted and effective treatment strategies.

The market landscape is further shaped by strategic acquisitions, as demonstrated by Abbott Laboratories' acquisition of Walk Vascular, LLC. By bringing additional capabilities, particularly in the domain of thrombectomy, Abbott Laboratories aims to strengthen its position in providing comprehensive solutions for the removal of blood clots. This strategic move not only broadens the scope of their offerings but also signifies a commitment to advancing surgical capabilities, which is crucial in the treatment of thrombus-related conditions.

These collective initiatives by major players in the thrombus treatment market are positioned to usher in a new era of more efficient and diversified products. The emphasis on innovation, both in therapeutic and diagnostic realms, aligns with the evolving needs of patients and healthcare professionals. As companies continue to invest in R&D, gain regulatory approvals, and expand their capabilities through strategic acquisitions, the thrombus treatment market is expected to witness sustained growth. These developments underscore the industry's commitment to addressing thrombus-related conditions comprehensively, paving the way for improved patient outcomes and advancements in the broader field of healthcare.

Leave a Comment