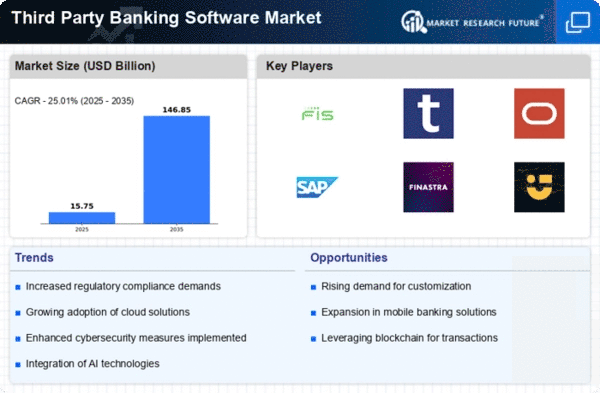

Market Growth Projections

The Global Third-Party Banking Software Industry Market is projected to experience remarkable growth, with expectations of reaching 147.0 USD Billion by 2035. This growth trajectory, characterized by a compound annual growth rate of 34.1% from 2025 to 2035, indicates a robust demand for innovative banking solutions. The increasing reliance on technology in financial services, coupled with the need for enhanced operational efficiency, positions third-party software as a vital component in the banking sector. As institutions continue to embrace digital transformation, the market is likely to expand significantly, reflecting the evolving needs of consumers and businesses alike.

Expansion of Fintech Ecosystem

The expansion of the fintech ecosystem is reshaping the Global Third-Party Banking Software Industry Market. The collaboration between traditional banks and fintech companies is fostering innovation and creating new opportunities for software providers. This partnership allows banks to integrate cutting-edge technologies and services without the need for extensive in-house development. As fintech solutions gain traction, the demand for third-party banking software that can seamlessly integrate with these services is expected to grow. This trend not only enhances the capabilities of financial institutions but also drives the overall market forward.

Growing Focus on Customer Experience

The emphasis on customer experience is a significant driver in the Global Third-Party Banking Software Industry Market. Financial institutions recognize that enhancing customer satisfaction is crucial for retention and growth. Third-party banking software solutions offer features that allow for personalized services, seamless transactions, and improved communication channels. By leveraging these tools, banks can create a more engaging and user-friendly experience for their clients. As customer expectations continue to rise, the adoption of third-party software that prioritizes user experience is likely to become a key differentiator in the competitive banking landscape.

Regulatory Compliance and Risk Management

Regulatory compliance remains a critical driver within the Global Third-Party Banking Software Industry Market. Financial institutions face stringent regulations that necessitate the adoption of sophisticated software solutions to ensure compliance with anti-money laundering, data protection, and financial reporting standards. Third-party banking software provides tools that facilitate real-time monitoring and reporting, thereby mitigating risks associated with non-compliance. As regulatory frameworks continue to evolve, the demand for compliant software solutions is likely to increase, further propelling market growth. Institutions that leverage third-party software to navigate these complexities may gain a competitive edge in the marketplace.

Technological Advancements and Innovation

Technological advancements play a pivotal role in shaping the Global Third-Party Banking Software Industry Market. Innovations such as artificial intelligence, machine learning, and blockchain are transforming the way financial services are delivered. These technologies enable banks to automate processes, enhance security, and improve customer engagement. As a result, third-party software providers are increasingly incorporating these technologies into their offerings, leading to more efficient and effective banking solutions. The anticipated growth of the market to 147.0 USD Billion by 2035 underscores the potential impact of these technological innovations on the industry.

Increasing Demand for Digital Banking Solutions

The Global Third-Party Banking Software Industry Market experiences a surge in demand for digital banking solutions as financial institutions seek to enhance customer experiences and streamline operations. With the global banking landscape evolving, institutions are increasingly adopting third-party software to provide innovative services such as mobile banking, online payments, and personalized financial management tools. This shift is evidenced by the projected market size of 5.83 USD Billion in 2024, indicating a robust growth trajectory. As banks strive to remain competitive, the integration of advanced technologies through third-party solutions becomes essential, thereby driving the overall market growth.