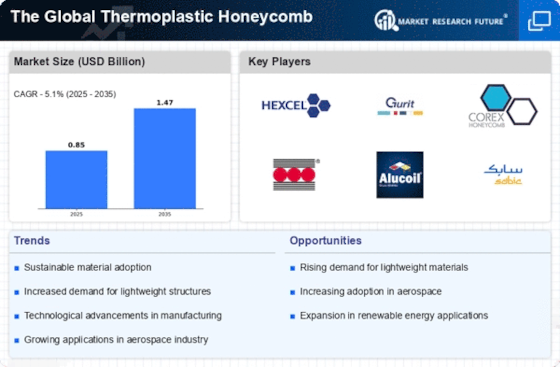

Top Industry Leaders in the Thermoplastic Honeycomb Market

Honeycomb's not just for bees anymore. Thermoplastic honeycomb, a lightweight, high-strength material mimicking nature's design, is buzzing with potential across industries, and the competition is heating up. Let's take a deep dive into this honeycomb marketplace, exploring the key players, their strategies, and the latest developments shaping its future.

Honeycomb's not just for bees anymore. Thermoplastic honeycomb, a lightweight, high-strength material mimicking nature's design, is buzzing with potential across industries, and the competition is heating up. Let's take a deep dive into this honeycomb marketplace, exploring the key players, their strategies, and the latest developments shaping its future.

Market Share Strategies: A Queen Bee's Guide

-

Innovation Hive: Leading players like Plascore and Corex Honeycomb are investing heavily in R&D, developing honeycomb cores with enhanced properties like fire retardancy and improved recyclability. Honeycomb composites with integrated functionalities are also on the rise, attracting new applications. -

Geographical Buzz: Expanding into emerging markets like China and India with cost-effective production and localized offerings is a key strategy. Companies like EconCore and Universal Metaltek are establishing footholds in these regions to cater to the growing demand. -

Diversification Symphony: Honeycomb producers are diversifying their product portfolios beyond traditional cores. Nidaplast, for instance, offers honeycomb panels, sandwich structures, and pre-impregnated composites, catering to varied customer needs. -

The Buzz of Sustainability: Sustainability is becoming a major differentiator. Players like Tubus Bauer are pioneering bio-based and recyclable honeycomb materials, addressing environmental concerns and attracting eco-conscious customers. -

Partnerships in the Hive: Strategic collaborations with material suppliers, research institutions, and end-use industry players are fostering innovation and market penetration. For example, Design Composite's partnership with Airbus is accelerating the adoption of honeycomb in lightweight aircraft structures.

Factors Dictating the Queen's Favor:

-

Industry Trends: Growth in key sectors like aerospace, automotive, and renewable energy is driving demand for lightweight, high-performance materials, favoring thermoplastic honeycomb. -

Technological Advancements: Automation in honeycomb production and development of advanced joining techniques are reducing costs and expanding application possibilities. -

Regulatory Landscape: Stringent fuel efficiency and emission regulations in sectors like automotive are pushing manufacturers towards lightweight materials like honeycomb. -

Price Point Shuffle: Fluctuations in raw material prices, particularly of oil-based thermoplastics, can impact the cost competitiveness of honeycomb compared to alternatives.

List of Key Players in the Thermoplastic Honeycomb Market

- Plascore (Germany),

- Corex Honeycomb (U.K.),

- EconCore (Belgium),

- Universal Metaltek (India),

- Design Composite GmbH (Austria),

- Nidaplast (France),

- Tubus Bauer GmbH (Germany)

Recent Developments:

-

December 2023: Universal Metaltek secures a major contract to supply honeycomb cores for high-speed trains in China, marking a significant entry into the transportation sector. -

January 2024: Plascore partners with a leading wind turbine manufacturer to develop lightweight honeycomb blades, aiming to improve efficiency and reduce noise pollution. -

February 2024: Corex Honeycomb enters the medical device market with its honeycomb cores for orthopaedic implants, capitalizing on the material's biocompatibility and strength. -

March 2024: Nidaplast expands its distribution network into Southeast Asia, targeting the region's booming construction and marine industries. -

April 2024: Tubus Bauer partners with a major consumer electronics company to develop honeycomb-based packaging solutions, aiming to reduce weight and environmental impact. -

May 2024: Design Composite and Airbus successfully test 3D-printed honeycomb components for aircraft seats, paving the way for wider adoption of this technology in the future.