Thawing System Size

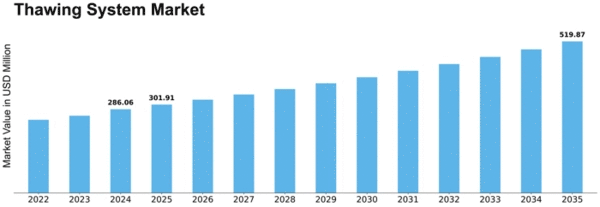

Thawing System Market Growth Projections and Opportunities

This market is driven by several market forces that shape its dynamics and growth path. One important factor is the growing demand for sophisticated medical technologies, particularly in healthcare. The continuous need for efficient and fast thawing of biological samples and products in the health care sector has led to the expansion of this market. Consequently, thawing systems are increasingly being adopted as medical researches/ applications grow more complex necessitating precise and swift thawing procedures.

Furthermore, global rise in chronic diseases together with increasing focus on personalized medicine are playing a leading role towards its evolution. Thawing system plays an essential role in conserving the integrity of biological materials including blood components or stem cells which are used in modern medical treatments. Increasing prevalence of chronic diseases alongside growing scope of personalized medication are driving demand for thawing systems across various healthcare facilities.

Another key market factor is the growing emphasis on food safety as well as surging demand for quick and convenient solutions in the food industry. They find extensive use when it comes to unfreezing frozen food products thereby ensuring rapid and controlled manner of achieving this objective. In order to improve their processes of production, food manufacturers have started adopting thawing systems because consumers have become increasingly critical about quality and safety issues related to food stuffs.Why then does all this mean?

Moreover, advancements and innovations taking place in this area dictate the market landscape today . Manufactures continue investing lots resources on research with an aim to come up with cutting-edge thawing technologies that offer enhanced efficiency, accuracy aiming at enhancing user-friendliness as well. At present, smart technology integration together with automation has taken roots into these defrost devices which cascades greater controls-monitoring by end users themselves.Consequently, there is expanding product base but also they are getting popular among various industries through such innovative processes.

Similarly, strict regulations & standards regarding handling or thawing biological materials affect how it operates.Thermo-Regulatory measures are very stringent in the healthcare, biotechnology & pharmaceutical sectors. These types of thawing systems which meet such standards that are set by authorities can experience an increase in demand as they help to maintain product integrity and quality. Therefore, manufacturers within the thawing system markets align their product development strategies with regulatory requirements in order to comply with strict standards.

Additionally, some regional factors such as economic development; healthcare infrastructure and overall industrial condition also affect the market. Emerging economies having a growing healthcare sector coupled with increasing investments into r&d represent lucrative thawing systems’ markets. In addition, expansion of these regions’ biopharmaceutical industries has resulted to the growth of this market since defrosting systems form a critical part of the production and development processes for biopharmaceutical products.”

Leave a Comment