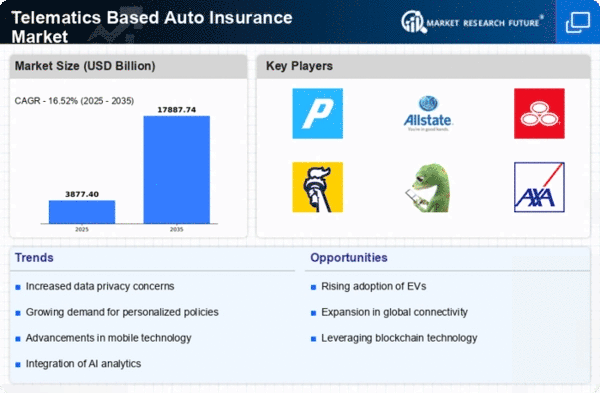

Market Growth Projections

The Global Telematics Based Auto Insurance Market Industry is poised for substantial growth, with projections indicating a market value of 57.6 USD Billion in 2024 and an anticipated increase to 310.9 USD Billion by 2035. This growth trajectory suggests a compound annual growth rate (CAGR) of 16.56% from 2025 to 2035. Such figures underscore the increasing integration of telematics in insurance models, driven by consumer demand for personalized and usage-based insurance solutions. The market's expansion reflects broader trends in technology adoption and changing consumer preferences.

Growing Awareness of Road Safety

The Global Telematics Based Auto Insurance Market Industry is significantly influenced by the increasing awareness of road safety among consumers. As accidents and traffic violations remain prevalent, drivers are more inclined to adopt telematics solutions that promote safer driving behaviors. Insurers leverage telematics data to provide feedback and incentives for safe driving, thereby reducing claims and improving overall road safety. This heightened focus on safety is likely to propel market growth, as consumers seek insurance products that not only protect them financially but also contribute to safer road environments.

Regulatory Support and Incentives

Regulatory frameworks increasingly support the adoption of telematics in the Global Telematics Based Auto Insurance Market Industry. Governments worldwide are recognizing the potential of telematics to improve road safety and reduce accidents. As a result, various incentives are being introduced to encourage insurers to adopt telematics-based models. For instance, some jurisdictions offer tax breaks or subsidies for companies implementing telematics solutions. This regulatory backing not only fosters innovation but also enhances consumer trust in telematics-based insurance, potentially driving market growth at a CAGR of 16.56% from 2025 to 2035.

Expansion of the Automotive Industry

The expansion of the automotive industry directly impacts the Global Telematics Based Auto Insurance Market Industry. As vehicle production and sales continue to rise globally, the demand for innovative insurance solutions grows correspondingly. New vehicle models increasingly come equipped with telematics systems, making it easier for insurers to integrate these technologies into their offerings. This trend is expected to drive market growth, as more consumers opt for telematics-based insurance products that align with their modern vehicles. The synergy between automotive advancements and telematics insurance is likely to create a robust market landscape.

Rising Demand for Usage-Based Insurance

The Global Telematics Based Auto Insurance Market Industry experiences a notable surge in demand for usage-based insurance models. Consumers increasingly prefer insurance policies that align premiums with actual driving behavior, promoting safer driving habits. This shift is evidenced by the growing adoption of telematics devices, which monitor driving patterns and provide real-time feedback. As a result, insurers can offer personalized premiums, enhancing customer satisfaction. The market is projected to reach 57.6 USD Billion in 2024, reflecting a significant transformation in consumer preferences towards more equitable insurance solutions.

Technological Advancements in Telematics

Technological innovations play a pivotal role in shaping the Global Telematics Based Auto Insurance Market Industry. The integration of advanced telematics systems, including GPS tracking and onboard diagnostics, enhances data collection and analysis capabilities. These technologies enable insurers to assess risk more accurately, leading to better pricing models. Furthermore, the rise of connected vehicles and the Internet of Things (IoT) facilitates seamless communication between vehicles and insurance providers. This evolution is expected to contribute to the market's growth, with projections indicating a value of 310.9 USD Billion by 2035.