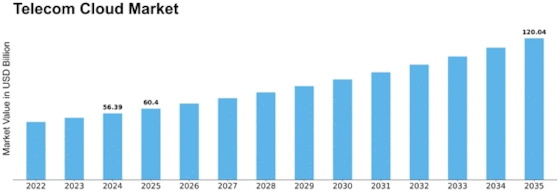

Telecom Cloud Size

Telecom Cloud Market Growth Projections and Opportunities

The dynamics and trajectory of the Telecom Cloud market within the telecoms sector are shaped by a number of important market variables. A primary contributing aspect is the growing demand for scalability and flexibility in networks. The challenges facing telecom operators include supporting future technologies like 5G, handling increasing data traffic, and adjusting to changing consumer needs. A scalable and adaptable infrastructure that enables telecom operators to effectively build, operate, and optimize network services is what the Telecom Cloud offers as a solution. This market element highlights how the telecom cloud is seen by the industry as a key enabler for meeting the changing needs of contemporary telecoms networks.

The continuous advancement of telecommunications technology, particularly with regard to the rollout of 5G networks, is a crucial market factor influencing the Telecom Cloud market. Telecom operators need cloud-native architectures to enable the low latency, higher bandwidth, and variety of use cases that come with 5G connection as they move toward 5G technology.

The infrastructure required to implement virtualized network services and handle the complexity of 5G networks is mostly provided by the telecom cloud. This market factor illustrates how 5G and the Telecom Cloud work together harmoniously, with cloud solutions acting as a key component in enabling the full potential of enhanced telecommunications capabilities. Security concerns are important market variables in the telecom cloud industry.

Ensuring the security and integrity of the huge volumes of sensitive data handled by telecom carriers is crucial. The necessity for strong security measures, encryption mechanisms, and adherence to industry standards to protect user data and uphold customer privacy and trust has a significant impact on the telecom cloud business. This market element emphasizes how important security is in determining how Telecom Cloud solutions are designed, implemented, and adopted by the telecom sector.

One important market element that spurs innovation and cooperation in the telecom cloud space is the competitive environment. The convergence of cloud service providers and traditional telecom suppliers is creating opportunities for joint ventures, mergers, and acquisitions.

Leave a Comment