Rise of Big Data Technologies

The Telecom Analytics Market is significantly influenced by the rise of big data technologies, which enable telecom operators to process and analyze large volumes of data efficiently. With the exponential growth of data generated from various sources, including mobile devices and IoT applications, telecom companies are increasingly adopting big data analytics solutions. This trend is reflected in the projected growth of the big data analytics market in telecom, which is expected to reach USD 10 billion by 2025. The ability to derive actionable insights from big data is likely to enhance operational efficiency and decision-making processes within the telecom sector.

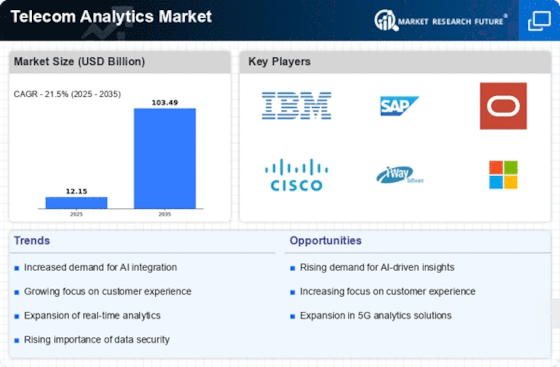

Adoption of AI and Machine Learning

The adoption of artificial intelligence (AI) and machine learning (ML) technologies is transforming the Telecom Analytics Market. Telecom operators are increasingly utilizing AI and ML algorithms to enhance predictive analytics capabilities, enabling them to forecast customer behavior and optimize network performance. This trend is underscored by the expected growth of the AI in telecom market, projected to reach USD 8 billion by 2025. By integrating AI and ML into their analytics frameworks, telecom companies can improve operational efficiency, reduce costs, and deliver more personalized services to customers, thereby driving the overall growth of the analytics market.

Regulatory Compliance and Data Security

Regulatory compliance and data security are becoming critical drivers in the Telecom Analytics Market. As telecom operators handle vast amounts of sensitive customer data, they are under increasing pressure to comply with stringent regulations regarding data protection and privacy. This has led to a surge in demand for analytics solutions that not only provide insights but also ensure compliance with regulations such as GDPR and CCPA. The market for compliance analytics in telecom is anticipated to grow significantly, as companies seek to mitigate risks associated with data breaches and non-compliance. This focus on security and compliance is likely to shape the future of analytics in the telecom sector.

Increasing Focus on Network Optimization

The increasing focus on network optimization is a key driver in the Telecom Analytics Market. As telecom operators strive to enhance service quality and reduce operational costs, they are turning to analytics solutions to optimize network performance. This trend is evident in the growing investment in network analytics tools, which are expected to reach USD 6 billion by 2026. By leveraging analytics, telecom companies can identify network bottlenecks, predict failures, and improve resource allocation. This proactive approach to network management is likely to enhance customer satisfaction and drive the adoption of analytics solutions within the industry.

Growing Demand for Enhanced Customer Experience

The Telecom Analytics Market is witnessing a growing demand for enhanced customer experience, driven by the need for personalized services and improved customer engagement. Telecom operators are increasingly leveraging analytics to gain insights into customer behavior, preferences, and usage patterns. This shift is evident as companies invest in advanced analytics tools to analyze vast amounts of data generated from customer interactions. According to recent estimates, the market for customer experience analytics in telecom is projected to reach USD 5 billion by 2026. This trend indicates that telecom companies are prioritizing customer satisfaction, which is likely to drive the adoption of analytics solutions in the industry.