Tackifier Size

Tackifier Market Growth Projections and Opportunities

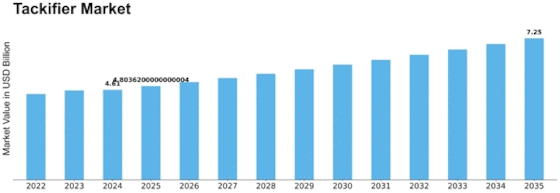

The Tackifier Market is driven by many factors that define its growth and veer. One major driver is an increased need of tackifiers across various industries, specifically in the adhesive and sealant industry. Adhesive formulations often include tackifiers as important ingredients that enhance their adhesive properties like bonding strength and tacking ability. The demand for tackifiers increases with the growing use of adhesives and sealants in construction, automotive, packaging, and other end-use industries thereby promoting market growth. Tackifier Market Size accounted for USD 4.2 Billion in 2022. The tackifier market was forecasted to expand from USD 4.402 Billion in 2023 to USD 6.4102 Billion by 2032 at a CAGR (Compound Annual Growth Rate) of 4.81%.

Additionally, the packaging industry has been at the forefront spurring the growth of tackifier market. Packaging adhesives used in various applications such as carton sealing, labeling and flexible packaging are made with essential components called tackifiers which contribute greatly towards this particular aspect among others related to sustainability characteristics. These should be able to produce adhesives satisfying demands for durability under intense conditions while also being environmentally friendly due to increased needs for sustainable packaging solutions globally addressing both performance and environmental criteria connected with these products. Another significant player in the tackifier market is the construction industry where needs arising from flooring, roofing and insulation materials are met through adhesive formulation using these substances [10]. Construction adhesives have improved adhesive strength brought about by use of these materials hence resulting into longer lasting bonded structures[9]. The demand for these commodities has thus gone up since infrastructure development including building constructions has been expanding a lot. Therefore, the construction industry’s performance trends directly influence adhesive applications demand for tackifiers.

Moreover, the automotive industry employs tackifiers in adhesive formulations used in interior trim, automotive seals and bonding during assembly processes. In addition to that, these products can be used as a part of different assemblies such as fasteners, gears etc., where they play an important role improving adhesion properties [11]. They have been found useful because their use has resulted into vehicle components being stuck together very firmly thus leading not only reliability but also long life of them. On the other hand, this sector has changed significantly with time due mainly towards technological changes associated increased desire for lighter vehicles. Consequently, there is need for performance-based tackifiers which meet stringent requirements in this industry.

Leave a Comment