Syrup Size

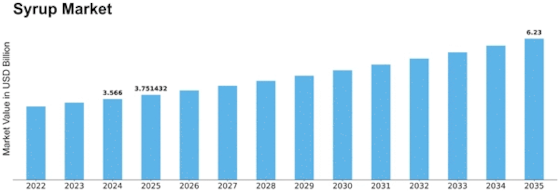

Syrup Market Growth Projections and Opportunities

The syrup market is influenced by several key factors that shape its growth and dynamics. One of the primary drivers of this market is changing consumer preferences and trends. As consumer tastes evolve, there is a growing demand for a variety of syrup flavors, ranging from traditional options like maple and chocolate to more exotic choices such as fruit-infused or artisanal syrups. Additionally, consumer preferences for healthier alternatives, such as natural sweeteners or sugar-free syrups, have contributed to the diversification of products available in the market.

Economic factors also play a significant role in shaping the syrup market. Fluctuations in disposable income levels can impact consumers' purchasing power and their willingness to spend on premium or specialty syrups. During periods of economic downturn, consumers may opt for more affordable options or reduce discretionary spending on non-essential food items like specialty syrups. Conversely, during economic upturns, consumers may be more inclined to indulge in higher-priced gourmet syrups, driving sales in this market segment.

Regulatory policies and standards are another crucial factor influencing the syrup market. Compliance with food safety regulations, labeling requirements, and ingredient standards is essential for syrup manufacturers to ensure consumer trust and meet legal obligations. Additionally, certifications such as organic or non-GMO may influence purchasing decisions, particularly among health-conscious consumers seeking cleaner and more sustainable options.

Technological advancements also impact the syrup market, particularly in manufacturing and packaging technologies. Improved production processes, such as automated syrup blending and bottling systems, can enhance efficiency and consistency in syrup production. Advanced packaging solutions, such as eco-friendly materials or portion-controlled packaging, can improve product freshness and appeal to environmentally conscious consumers.

Competitive dynamics and market competition are significant factors in shaping the syrup market. Established brands with strong brand recognition and distribution networks may dominate shelf space and consumer preferences, making it challenging for new entrants to gain market share. However, innovative startups and niche players can disrupt the market with unique offerings, such as specialty flavors or functional syrups with added vitamins or antioxidants, catering to specific consumer segments and driving innovation in the market.

Changing consumer lifestyles and dietary preferences also influence the syrup market. The growing demand for healthier options, such as natural or organic syrups, reflects shifting consumer attitudes towards wellness and nutrition. Additionally, lifestyle trends such as increased interest in gourmet cooking and mixology have contributed to the popularity of premium syrups for use in cocktails, mocktails, and culinary creations.

Moreover, external factors such as weather conditions and agricultural trends can impact syrup production and pricing. Variations in crop yields or environmental factors may affect the availability and cost of raw materials used in syrup production, influencing supply chain dynamics and production costs for syrup manufacturers.

Leave a Comment