- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

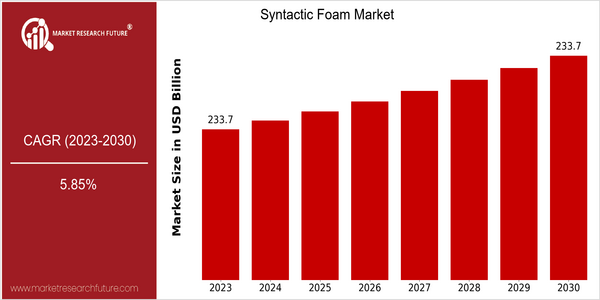

Syntactic Foam Market Size Snapshot

| Year | Value |

|---|---|

| 2023 | USD 233.7 Billion |

| 2030 | USD 233.7 Billion |

| CAGR (2023-2030) | 5.85 % |

Note – Market size depicts the revenue generated over the financial year

The Syntactic Foam Market is estimated to reach a value of USD 233.75 billion in 2023, and is forecast to retain this value by the end of the forecast period, showing a CAGR of 5.8 % from 2019 to 2028. This steady market size reflects the underlying strength of the demand for syntactic foams, which are increasingly used in a wide range of industries, such as the aeronautical, marine and construction industries. The syntactic foam market is driven by several factors. In particular, technological advances in the field of material science have made it possible to develop more efficient and versatile formulations of syntactic foams, thereby improving their performance characteristics. Also, the growing need for lightweight materials in industries wishing to reduce their fuel consumption and CO2 emissions also drives market growth. In this market, the leading companies such as 3M, BASF and Huntsman have been deploying a series of strategic initiatives, including collaborations and product innovations, to strengthen their market positions and improve their product offerings. For example, the recent investments in R&D for the development of eco-friendly syntactic foam solutions reflect the industry's growing focus on sustainability, in line with global trends and regulatory requirements.

Regional Deep Dive

The Syntactic Foam Market is growing at a rapid pace in several regions, driven by increasing demand in the aeronautical, marine, and automobile industries. North America is characterized by technological innovation and the presence of key players, while Europe is focused on ensuring compliance with regulations. The Asia-Pacific region is characterised by rapid industrialization and the development of its transportation network, which is driving the demand for lightweight materials. The Middle East and Africa (MEA) are benefitting from the exploration of hydrocarbons, while Latin America is adopting syntactic foam solutions more and more in the construction and automobile industries.

North America

- In the United States Navy, several projects are in hand to employ syntactic foam for underwater applications, thus increasing the material’s importance in the defense field.

- Companies such as 3M and BASF are investing in research and development to create advanced products made from syntactic foam, which are in line with the strictest of environmental standards. The trend towards more sustainable materials is reflected in this investment.

- The American aeronautics industry is now using more and more syntactic foam because of its lightness, which increases fuel economy and reduces emissions.

Europe

- Having imposed on the automobile industry regulations which compel the use of light materials, syntactic foam is gaining in importance.

- Huntsman has been working on new formulations for syntactic foam that improve its insulating and sound-proofing properties.

- A growing emphasis on sustainable development has led to a closer collaboration between universities and industry in Europe to develop bio-based alternatives to syntactic foam.

Asia-Pacific

- China's fast urbanization and its massive public works have greatly increased the demand for syntactic foam in the construction industry, especially in high-rise buildings.

- Japan is the world's leading developer of advanced syntactic foam, which is used in the construction of earthquake-resistant structures, and this is a reflection of the region's emphasis on disaster prevention.

- The automobile industry of South Korea has already been able to reduce the weight of the car by using the syntactic foam in the chassis, and the trend of the world is to make the car lighter.

MEA

- In the United Arab Emirates, oil and gas companies are using syntactic foam for buoyancy applications in offshore drilling. This highlights the importance of this material in the field of energy exploration.

- In the recent diversification of the Saudi economy, a number of industries are relying on the use of new materials such as polyurethane foam.

- In Africa, where there is growing interest in the field of new energy sources, the use of syntactic foams in the manufacture of wind-turbine blades is increasing.

Latin America

- Brazil is experiencing a growth in the use of XPS in the construction sector, driven by the development of government projects in the field of public works.

- The Mexican automobile industry is increasingly using this material to reduce the weight of components, which in turn increases the fuel economy of automobiles.

- The Argentinean government has recently passed laws promoting the use of advanced materials in manufacturing. This is expected to boost the syntactic foam market in the region.

Did You Know?

“Syntactic foam is up to 90 per cent lighter than traditional materials, which makes it an excellent choice for applications where weight is a critical factor.” — Journal of Materials Science

Segmental Market Size

The Syntactic Foam Market is currently experiencing a steady growth, driven by the unique properties of the material, which offers lightweight and high-strength solutions for various applications. The main factors driving the market are the need for lightweight and fuel-efficient materials in the aviation industry, and the marine industry's need for durable and weather-resistant materials. Also, technological developments are making syntactic foams more available and cost-effective for a wider range of applications.

At present, the syntactic foams are used in the field at a large scale, with 3M and BASF leading the way in the development of the technology. They are used as buoyancy aids in underwater vehicles and as insulating material in aircraft components. The trend towards sustainability and the drive for lightweight construction in the transport industry is driving growth in the sector, while 3D printing and the use of advanced composite materials are shaping its evolution. These developments will be of great importance for the future of the engineering industry.

Future Outlook

The Syntactic Foam Market is projected to grow at a CAGR of 5.8 % from 2023 to 2030. It is a result of the increasing demand for lightweight and high-strength materials in the aerospace, marine and automotive industries. The growing trend of adopting energy-efficient and sustainable materials is likely to drive the adoption of syntactic foams, with the penetration rate in specialized applications potentially reaching 15% by 2030. The current market size of $233.7 million is expected to stay stable, a result of the growing demand for these materials, driven by technological advancements and material innovations.

The main driving forces for the expansion of the syntactic foams market are the new resin formulations and improved processing techniques. These developments are expected to lower the cost of production and increase the performance of the syntactic foams. Furthermore, the government regulations for the use of lightweight materials in order to reduce fuel consumption and carbon emissions will boost the growth of the market. The development of new trends, such as the integration of smart materials and the use of bio-based materials, will also contribute to the growth of the market. These trends will lead to the evolution of the syntactic foams market and will create new opportunities for the producers and the end-users.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Growth Rate | 5.85% (2021-2028) |

Syntactic Foam Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.