Top Industry Leaders in the Switchgear Market

*Disclaimer: List of key companies in no particular order

Latest Company Updates:

Competitive Landscape of Air Insulated Switchgear Market

The air insulated switchgear (AIS) market, pulsates with fierce competition. Established players and nimble entrants grapple for market share, employing diverse strategies to solidify their positions. Here, we delve into the intricate tango of this market, dissecting key player strategies, insightful market share analysis factors, and burgeoning trends shaping the competitive landscape.

Key Player Strategies:

Technological Prowess: Leading players like ABB, Siemens, and Schneider Electric invest heavily in R&D, focusing on compact AIS designs, enhanced operational efficiency, and smart grid integration capabilities. Siemens' SENTRON switchgear exemplifies this with its digital connectivity features.

Geographic Expansion: Global giants like Mitsubishi Electric and Eaton prioritize strategic acquisitions and partnerships to penetrate emerging markets, especially in Asia Pacific and Latin America. Eaton's acquisition of CESMEC in India is a prime example.

Vertical Focus: Specialized players like WEG and Elind Electric cater to specific industry segments like renewable energy and transportation, offering customized AIS solutions. WEG's focus on wind power projects demonstrates this strategy.

Cost Optimization: Price sensitivity, particularly in developing economies, drives many players to optimize production processes and materials. Local manufacturers in China and India leverage this strategy effectively.

After-Sales Service: Proactive maintenance and reliable spare parts supply are crucial differentiators. ABB's PowerCare program and Schneider Electric's EcoStruxure services showcase this commitment.

Market Share Analysis Factors:

Brand Reputation: Established players with proven track records and extensive product portfolios, like ABB and Siemens, often enjoy a competitive edge.

Technological Superiority: AIS manufacturers offering advanced features like vacuum circuit breakers and digital fault detection command higher premiums and attract premium customers.

Geographical Reach: Companies with strong networks in specific regions, like Schneider Electric in Europe and WEG in South America, hold strong market positions within their territories.

Cost Competitiveness: Efficient production and lower material costs enable manufacturers like Chinese players to undercut competitors on price, impacting market share in cost-sensitive segments.

Government Regulations: Stringent safety and environmental regulations, like IEC standards, necessitate compliance, influencing supplier selection and market dynamics.

New and Emerging Trends:

Smart Grid Integration: The integration of sensors, communication technologies, and data analytics platforms into AIS is transforming the market, enabling remote monitoring, predictive maintenance, and grid optimization.

Modular Switchgear: Modular designs offering flexibility in configuration and scalability are gaining traction, catering to diverse power requirements and reducing installation times.

Sustainable Materials: Environmental concerns are driving the adoption of biodegradable and recyclable materials in AIS production, aligning with green energy initiatives.

Digital Twins: Creating digital replicas of AIS equipment for virtual testing and optimization is gaining momentum, improving design efficiency and reducing physical prototyping costs.

Regional Growth: Asia Pacific and Latin America are predicted to be the fastest-growing markets, driven by rapid infrastructure development and increasing electrification rates.

Overall Competitive Scenario:

The AIS market is characterized by intense competition, with established players facing pressure from both cost-competitive Asian manufacturers and innovative niche players. Technological advancements, regional market growth, and the focus on sustainability are shaping the competitive landscape. To thrive, players must adapt their strategies, prioritize R&D, and cater to specific customer needs, while constantly navigating the evolving regulatory and environmental landscape. The future of the AIS market promises continued dynamism, offering exciting opportunities for players who can adapt and innovate in this dynamic ecosystem.

Schneider Electric SE (France):

• Date: December 28, 2023

• Development: Announced partnership with Google Cloud to develop AI-powered energy management solutions for buildings. (Source: Schneider Electric Press Release)

Eaton Corporation PLC (Ireland):

• Date: December 5, 2023

• Development: Completed acquisition of U.S.-based electrical vehicle charging company ClipperCreek for $1.6 billion. (Source: Eaton Press Release)

General Electric Company (U.S.):

• Date: December 19, 2023

• Development: Signed a $430 million contract to supply gas turbines for a power plant in Oman. (Source: GE Press Release)

Toshiba Corporation (Japan):

• Date: December 27, 2023

• Development: Successfully tested its next-generation sodium-ion batteries, offering a possible alternative to lithium-ion batteries. (Source: Nikkei Asian Review)

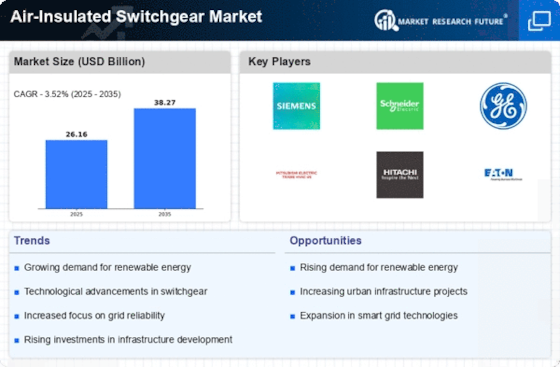

Top listed global companies in the industry are:

ABB Ltd. (Switzerland), Schneider Electric SE (France), Eaton Corporation PLC (Ireland), Siemens AG (Germany), General Electric Company (U.S.), Larsen & Toubro Limited (India), Toshiba Corporation (Japan), Crompton Greaves Ltd. (India), Ormazabal (Brazil), C&S Electric (India), Lucy Electric (UK), TEPCO Group (Japan), and Alfanar Group (Saudi Arabia)