Increasing Focus on Patient Safety

The Surgical Staplers Market is witnessing a heightened emphasis on patient safety, which is influencing the adoption of advanced surgical staplers. Healthcare providers are increasingly prioritizing tools that minimize the risk of surgical site infections and other complications. This focus on safety is prompting hospitals to invest in high-quality surgical staplers that meet stringent regulatory standards. Data suggests that surgical staplers with enhanced safety features are becoming more prevalent in operating rooms, as they contribute to improved patient outcomes. Consequently, the demand for such innovative products is likely to bolster the Surgical Staplers Market, as healthcare institutions strive to enhance their surgical practices.

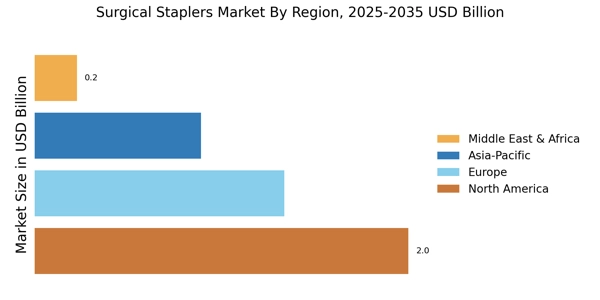

Growth of Ambulatory Surgical Centers

The expansion of ambulatory surgical centers (ASCs) is significantly impacting the Surgical Staplers Market. ASCs are increasingly preferred for various surgical procedures due to their cost-effectiveness and efficiency. This trend is leading to a higher volume of outpatient surgeries, which in turn drives the demand for surgical staplers. As ASCs continue to proliferate, they are likely to adopt advanced surgical stapling technologies to enhance their operational efficiency. The growth of ASCs presents a substantial opportunity for the Surgical Staplers Market, as these facilities seek to provide high-quality care while managing costs effectively.

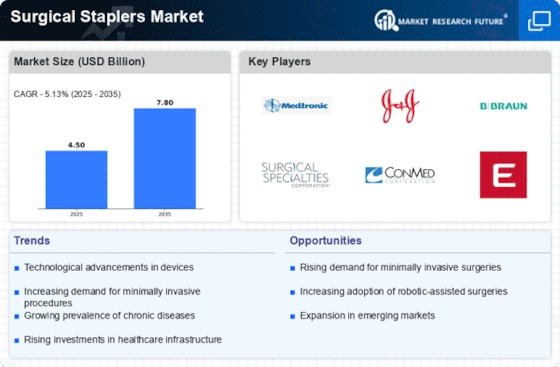

Rising Demand for Surgical Procedures

The Surgical Staplers Market is experiencing a notable increase in demand for surgical procedures, driven by a growing prevalence of chronic diseases and an aging population. As healthcare systems evolve, the need for efficient and effective surgical solutions becomes paramount. According to recent data, the number of surgical procedures performed annually is projected to rise significantly, which in turn fuels the demand for surgical staplers. This trend indicates that healthcare providers are increasingly adopting advanced surgical techniques, thereby enhancing the overall efficiency of surgical operations. The rising demand for surgical procedures is likely to propel the Surgical Staplers Market forward, as hospitals and surgical centers seek to improve patient outcomes and reduce recovery times.

Regulatory Support for Surgical Innovations

The Surgical Staplers Market is benefiting from supportive regulatory frameworks that encourage innovation in surgical technologies. Regulatory bodies are increasingly recognizing the importance of advanced surgical staplers in improving surgical outcomes and patient safety. This support is facilitating the introduction of new products and technologies into the market, thereby fostering competition and driving growth. As regulatory processes become more streamlined, manufacturers are likely to accelerate their product development efforts, leading to a wider array of surgical staplers available to healthcare providers. This regulatory environment is expected to play a crucial role in shaping the future of the Surgical Staplers Market.

Technological Innovations in Stapler Design

Technological advancements in the design and functionality of surgical staplers are transforming the Surgical Staplers Market. Innovations such as the development of automated stapling devices and advanced materials are enhancing the precision and reliability of surgical staplers. These innovations not only improve surgical outcomes but also reduce the risk of complications associated with traditional stapling methods. The introduction of smart staplers equipped with sensors and feedback mechanisms is indicative of the industry's shift towards more sophisticated surgical tools. As these technologies continue to evolve, they are expected to drive growth in the Surgical Staplers Market, attracting investments and encouraging further research and development.