Surfactants Size

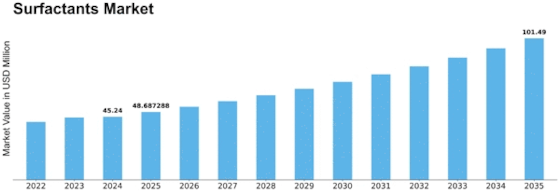

Surfactants Market Growth Projections and Opportunities

As a class of crucial compounds, surfactants have many applications and uses. There are hydrophilic (water-attracting) and hydrophobic (water-repelling) regions in their unusual chemical structure. Their unique quality distinguishes them from other substances. They are unique due to their chemical composition. This is the mechanism via which surfactants acquire their characteristics. In order to facilitate the spreading and simultaneous mixing of liquids with other substances, surfactants may reduce the surface tension of other substances. Because of their bifunctional nature, surfactants are able to do both of these tasks simultaneously. Declining demand for the product followed COVID-19's massive impact on the market. Immediately after the statement, something occurred. In contrast, the product's demand has skyrocketed since the epidemic began. The low surface tension is a crucial characteristic of surfactant class compounds. In addition to households, they find usage in the textile and personal care industries. This is also the case in the beverage and food industry. Business that use detergent are expected to grow a lot over the next few years, according to the prediction. Detergents will be needed more because the cloth and food and drink businesses are expected to grow. The largest percentage of the Asia-Pacific market belongs to China. The country will be experiencing tremendous expansion of the personal care and beauty industry. The burgeoning population is boosting the demand for detergents, personal care items and soaps. This will mean considerable growth of the surfactants market in the country in subsequent years. Products like soaps, makeup, and many more are made in China's chemical business. It is made by more than 60 companies across the country. However, Evonik Industries AG and BASF SE are two of the biggest companies in the business being studied. An important business in China is making soaps and cleaners. Among the world's leading soap producers, it ranks high as well. The average China consumer makes use of around 800 grams of soap every day for personal care and cleaning. About 65% of the people who live in India live in rural places. When people's spending income rises and national markets get bigger, they tend to buy more expensive things. This change is likely to help the cleaning business in the country. The number of experts who need detergents has hit an all-time high. This is a direct result of the huge growth in the personal care and makeup industries. Because people are always looking for better products, more and more skin care, hair, and body washes use specialty cleansers. Since this happened, more and more goods started using these cleansers. Surfactants is used significantly in the agriculture sector to ensure that a variety of agrochemicals such as herbicides, insecticides and fertilizers are distributed evenly. Surfactants are very important to modern farming because they increase food yields, which leads to huge market growth. Because without them, we can't make surfactants. Manufacture and use of cleansers might be bad for the earth, though. Every living thing needs environments to stay alive. Inorganic lubricants hurt environments because they dirty the air and stop things from breaking down naturally. Soaps for cleaning and farming are especially relevant to our subject. According to the estimates, this part will also slow the growth of the soap business over the next few years.

Leave a Comment