Market Trends

Key Emerging Trends in the Supercomputer Market

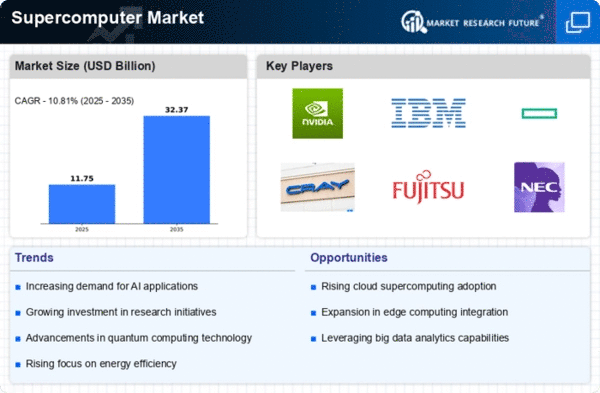

The Supercomputer market is witnessing several noteworthy trends that are shaping its trajectory and influencing the industry's future. Firstly, there is a clear trend towards increased computational power and performance. As applications become more complex, there is a growing demand for supercomputers with higher processing speeds, advanced parallel processing capabilities, and improved energy efficiency. Manufacturers are focusing on developing innovative solutions to meet these escalating performance expectations.

Another prominent trend is the integration of artificial intelligence (AI) and machine learning (ML) capabilities into supercomputing systems. The convergence of high-performance computing and AI is transforming various industries, including healthcare, finance, and research. Supercomputers are being designed to handle the massive data sets required for AI and ML applications, opening up new possibilities for advanced simulations, data analytics, and scientific research.

Energy efficiency is emerging as a critical trend in the Supercomputer market. With a growing awareness of environmental sustainability, manufacturers are investing in research and development to create supercomputing solutions that are not only powerful but also energy-efficient. This trend aligns with global efforts to reduce the carbon footprint of high-performance computing, making it more environmentally friendly.

Quantum computing is gaining momentum as a transformative trend in the Supercomputer market. While still in the early stages of development, quantum computers have the potential to revolutionize computing by leveraging the principles of quantum mechanics. Companies are exploring quantum computing as the next frontier in high-performance computing, aiming to overcome the limitations of classical computing and solve problems currently deemed unsolvable.

Edge computing is another trend influencing the Supercomputer market. As the Internet of Things (IoT) continues to proliferate, there is a growing need for supercomputing capabilities at the edge of networks. Edge computing enables real-time processing of data generated by IoT devices, reducing latency and enhancing the overall efficiency of applications such as autonomous vehicles, smart cities, and industrial automation.

Hybrid and heterogeneous computing architectures are gaining traction as a trend in the Supercomputer market. Instead of relying solely on traditional central processing units (CPUs), supercomputers are incorporating graphics processing units (GPUs), field-programmable gate arrays (FPGAs), and other specialized accelerators. This trend enhances overall system performance by leveraging the strengths of different processing elements for specific tasks.

The democratization of supercomputing is a notable trend, driven by cloud computing services and advancements in accessibility. Cloud-based supercomputing allows organizations and researchers to access high-performance computing resources without the need for substantial upfront investments in infrastructure. This trend is making supercomputing capabilities more accessible to a broader range of users, fostering innovation across various industries.

Security and data privacy are becoming increasingly important trends in the Supercomputer market. As supercomputers handle vast amounts of sensitive data, there is a growing emphasis on implementing robust cybersecurity measures. Manufacturers are incorporating advanced security features to protect against cyber threats and ensure the integrity of data processed by supercomputing systems.

Interconnectivity is a key trend influencing supercomputing architectures. High-speed and low-latency interconnects are essential for facilitating communication between different components within a supercomputer. Advancements in interconnect technologies contribute to improved overall system performance, scalability, and efficiency.

Leave a Comment